- The USD/CAD bias is bullish despite minor retreats.

- The false breakouts signaled exhausted buyers.

- The Canadian inflation data should bring sharp movements.

The USD/CAD price is trading at 1.3567 at the time of writing. The pair seems overbought in the short term. The greenback remains strong which dominates the currency market.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

The price increased even though the Canadian IPPI and RMPI came in better than expected yesterday.

On the contrary, the US NAHB Housing Market Index also came in better than expected. The USD appreciated versus its rivals after the US reported higher inflation in February.

Today, the Canadian inflation figures could be decisive. The Consumer Price Index is expected to report a 0.6% growth in February versus a 0.0% growth in January.

In addition, the Core CPI, Median CPI, Trimmed CPI, and Common CPI data will also be released. Higher inflation could lift the CAD.

On the other hand, the US is to release the Building Permits indicator, which is expected at 1.50M above 1.47M in the previous reporting period, while Housing Starts could jump from 1.33M to 1.43 M.

The FED will keep the monetary policy tomorrow, but the FOMC Press Conference should shake the markets.

USD/CAD Price Technical Analysis: Swing Higher

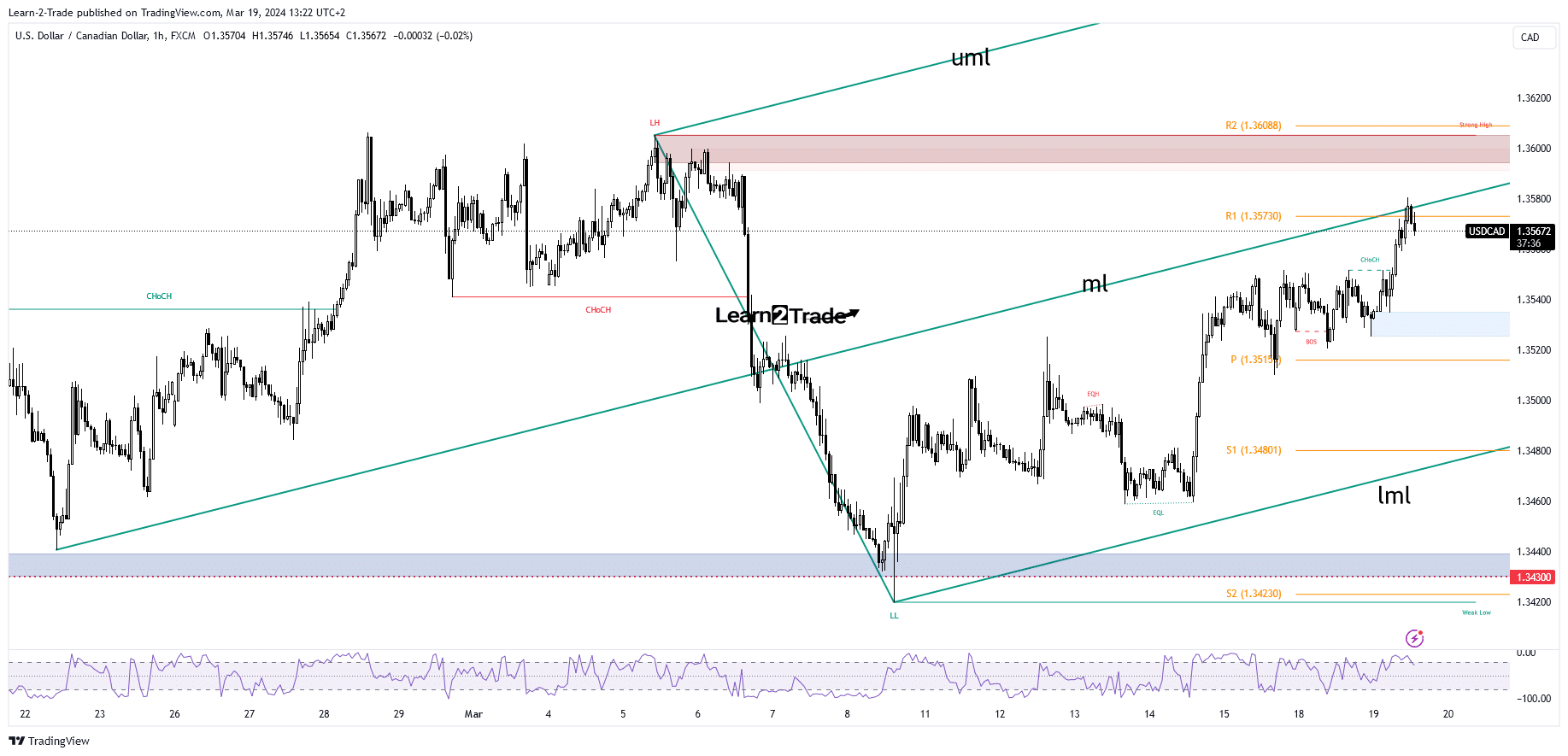

Technically, the USD/CAD price developed a strong upward movement after registering a false breakdown with a great fall below the 1.3430 static support.

-Are you interested in learning about the forex signals telegram group? Click here for details-

Now, it has reached the median line (ml) of the ascending pitchfork, representing a dynamic resistance. The false breakout through this line and above the weekly R1 of 1.3573 signaled exhausted buyers and indicated a potential sell-off.

After such impressive growth, a correction could be expected. The price could come back down, trying to accumulate more bullish energy before developing a new bullish momentum. Taking out the median line (ml) and creating a new higher high activates an upside continuation. The bias is bullish in the short term despite minor retreats.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.