- Despite the upbeat Spanish CPI, the EUR/USD price remains under selling pressure.

- Markets await the Final US GDP Price Index for fresh momentum.

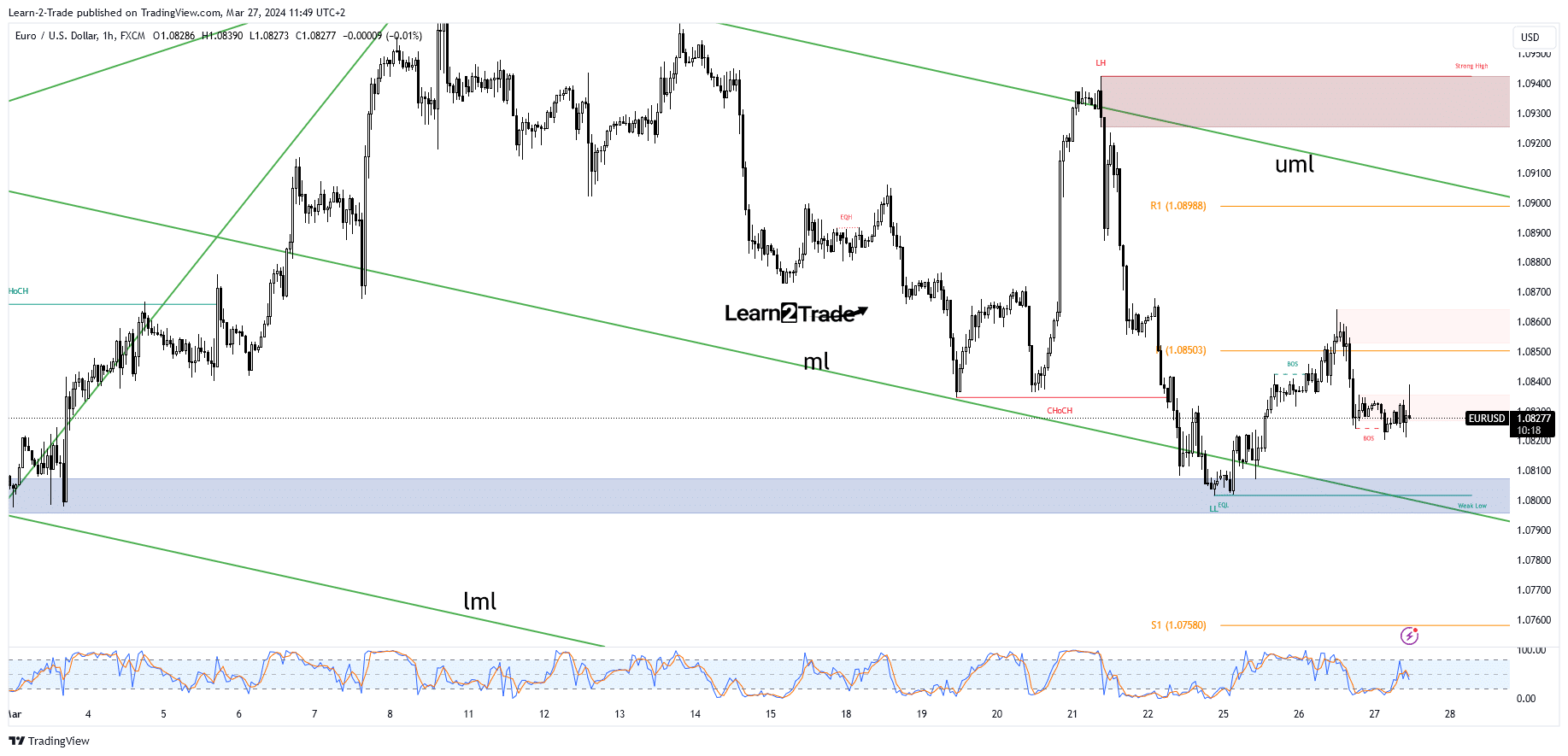

- Technically, the 1.0800 level provides strong support.

The EUR/USD price remained bearish on Wednesday despite minor rebounds. The pair is trading at 1.0820 at the time of writing. The bearish trend remains dominating amid a stronger dollar.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The greenback remains bullish despite some poor US economic data reported yesterday. The CB Consumer Confidence came in at 104.7 points below 106.9 points expected and under 104.8 in the previous reporting period.

Richmond Manufacturing Index was reported at -11 points versus the -5 estimated, HPI dropped by 0.1% even if the traders expected a 0.2% growth, while the S&P/CS Composite-20 HPI matched expectations.

Furthermore, the Durable and Core Durable Orders came in better than expected.

Today, the Spanish Flash CPI came in better than expected, but the EUR could not capitalize on it. The German Retail Sales and German Unemployment Change could bring life to the EUR/USD pair tomorrow.

The US will release Revised UoM Consumer Sentiment, Pending Home Sales, Final GDP, Unemployment Claims, Chicago PMI, and Final GDP Price Index. Positive economic data lifts the greenback.

EUR/USD Price Technical Analysis: Sellers in Charge

Technically, the currency pair rebounded after failing to reach the 1.08 psychological level or to stay below the descending pitchfork’s median line (ml). The rebound was temporary as the price couldn’t stay above the weekly pivot point of 1.0850.

-Are you interested in learning about the forex indicators? Click here for details-

After the minor rally, a retreat could be natural as the price could try to retest the support levels and demand zones to accumulate bullish energy and buyers. We have a strong demand zone above the 1.08 psychological level.

Retesting this zone and printing only false breakdowns should trigger a new bullish momentum. Dropping and closing below 1.08 and under the median line (ml) may ignite further declines.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.