- Fed’s Waller said the recent inflation readings support a delay in rate cuts.

- The likelihood of a Fed rate cut in June has fallen to 60%.

- BoE’s Jonathan Haskel warned against expecting early rate cuts.

The GBP/USD outlook is bearish as the dollar gains strength amidst fading expectations of a Fed rate cut. Moreover, market participants are gearing up for more economic data from the US that might give clues on Fed rate cuts.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The dollar strengthened after Fed Governor Christopher Waller said the recent inflation readings support a delay in Fed rate cuts. Notably, some policymakers have lost confidence in the progress of inflation after the last report beat forecasts. As a result, investors are also doubting whether the Fed will be able to implement three rate cuts.

The likelihood of a rate cut in June has fallen to 60%, boosting the dollar. However, this figure could change as more data comes in. The US will release data on GDP and jobless claims. However, the focus is on Friday’s core PCE report, which will show the state of inflation.

Another higher-than-expected inflation figure could further strengthen the dollar, as it would diminish rate-cut expectations. Moreover, markets might price in less than three cuts in 2024.

Meanwhile, the Bank of England has assumed a more dovish stance. However, some policymakers still believe rate cuts are a long way off. BoE’s Jonathan Haskel warned against expecting early rate cuts. According to him, although headline inflation has dropped, the BoE is focused on persistent and underlying inflation, which remains high. Therefore, June might be too early for the central bank to start easing its monetary policy. Markets currently expect the first cut to be in June or August.

GBP/USD key events today

- US final quarter-on-quarter GDP

- US initial jobless claims

- US pending home sales

- US consumer sentiment

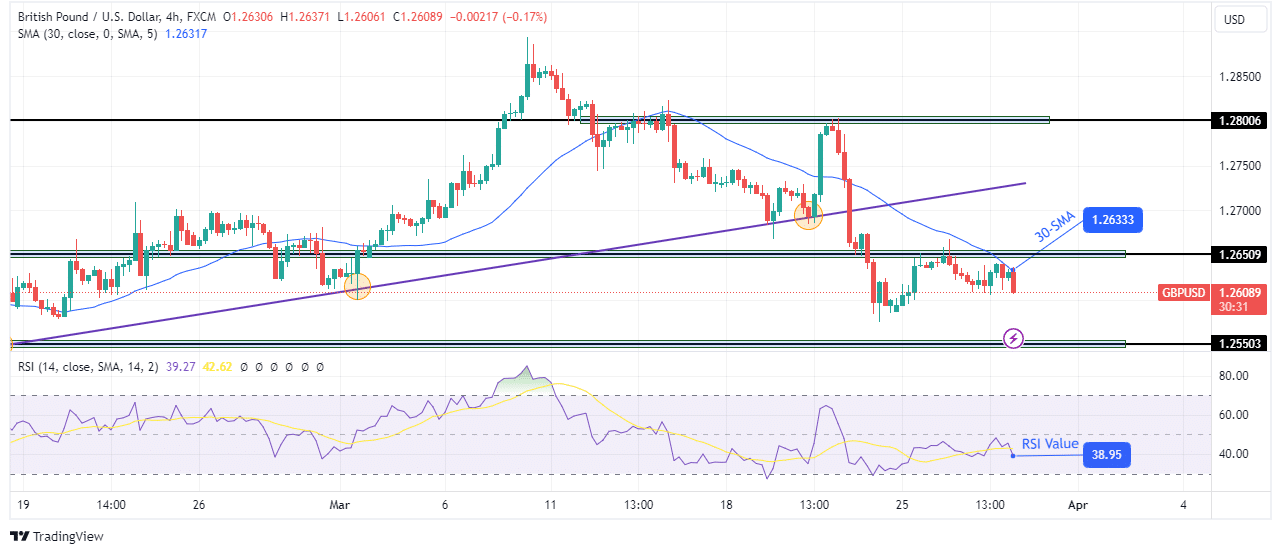

GBP/USD technical outlook: Price dips following 1.2650 resistance

On the charts, the GBP/USD price is declining after retesting and respecting the 1.2650 key resistance level. The bearish bias is strong as the price has established its downtrend with lower highs and lows. At the same time, it is now respecting the 30-SMA as resistance and might soon swing well below the line.

-Are you interested in learning about the forex indicators? Click here for details-

Meanwhile, the RSI is in bearish territory, below 50. Therefore, bears might soon make another lower low. The next immediate target for the downtrend is at the 1.2550 support level. The decline will continue below this level if the price stays below the SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.