- The yen recovered as investors became cautious amid intervention warnings.

- Masato Kanda warned that authorities would do everything necessary to support the yen.

- Economists believe the US GDP will hold at 3.2%.

The USD/JPY forecast leans slightly bearish as Japan’s intervention warnings breathe new life into the yen. After hitting a 34-year low on Wednesday, the yen recovered as investors became cautious amid warnings from Japanese authorities.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Notably, the yen has weakened sharply since the Bank of Japan shifted its monetary policy by hiking interest rates. This weakness came as markets realized that the shift in policy would be slow and gradual. Consequently, the gap in interest rates between the US and Japan will remain significant. Still, Japanese policymakers believe the market reaction is exaggerated. Therefore, a number of top officials have come out to warn markets against sharp declines in Japan’s currency.

On Wednesday, top currency diplomat Masato Kanda warned that authorities would do everything necessary to stop further sharp currency moves. However, current fundamentals show a possible further downside for the currency. A slow hiking cycle would keep the yen vulnerable as other major central banks maintain higher interest rates.

Additionally, inflation might miss BoJ forecasts as economists expect a drop in Tokyo’s inflation. Therefore, there is a big chance that Japan will step in to support its weak currency.

On the other hand, the dollar was steady on Thursday as investors prepared for more economic data. The US will release data on economic growth and unemployment claims. Economists believe the US GDP will hold at 3.2%. A higher-than-expected figure could push USD/JPY higher.

USD/JPY key events today

- US final GDP q/q

- US unemployment claims

- US pending home sales m/m

- US consumer sentiment

USD/JPY technical forecast: Bears signal a looming takeover

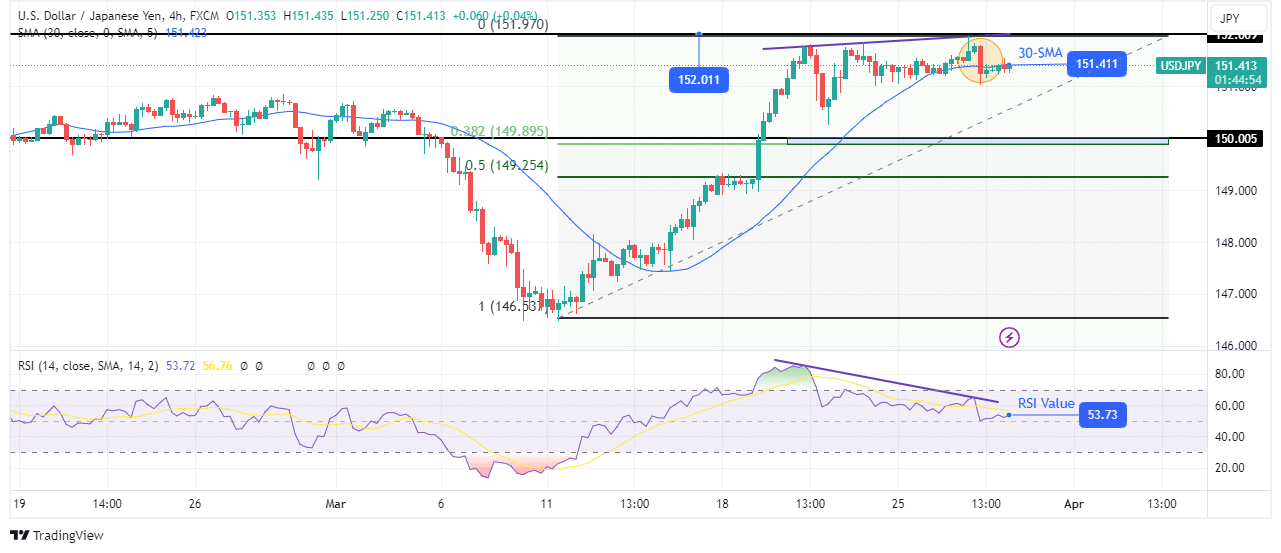

On the technical side, the USD/JPY price is retreating after nearing the 152.01 key resistance level. Moreover, bears are attempting a takeover that would see the price decline. The bullish trend weakened when the price neared 152.01. Notably, the price started trading near the 30-SMA support, and the RSI showed a bearish divergence.

-Are you interested in learning about the forex indicators? Click here for details-

Furthermore, bears showed strength when the price made a solid bearish engulfing candle that broke below the 30-SMA. At the moment, the price is still retesting the recently broken SMA. If bears are ready to take over, the price will soon retest to the 150.00 key support level, which is near the 0.382 Fib retracement level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.