As expected, the Bank of Canada leaves rates unchanged at 0.50%. The statement is not extremely dovish. They see current monetary policy as appropriate and do not provide hints of further rate cuts. Regarding the inflation mandate, the BOC sees risks as roughly balanced.

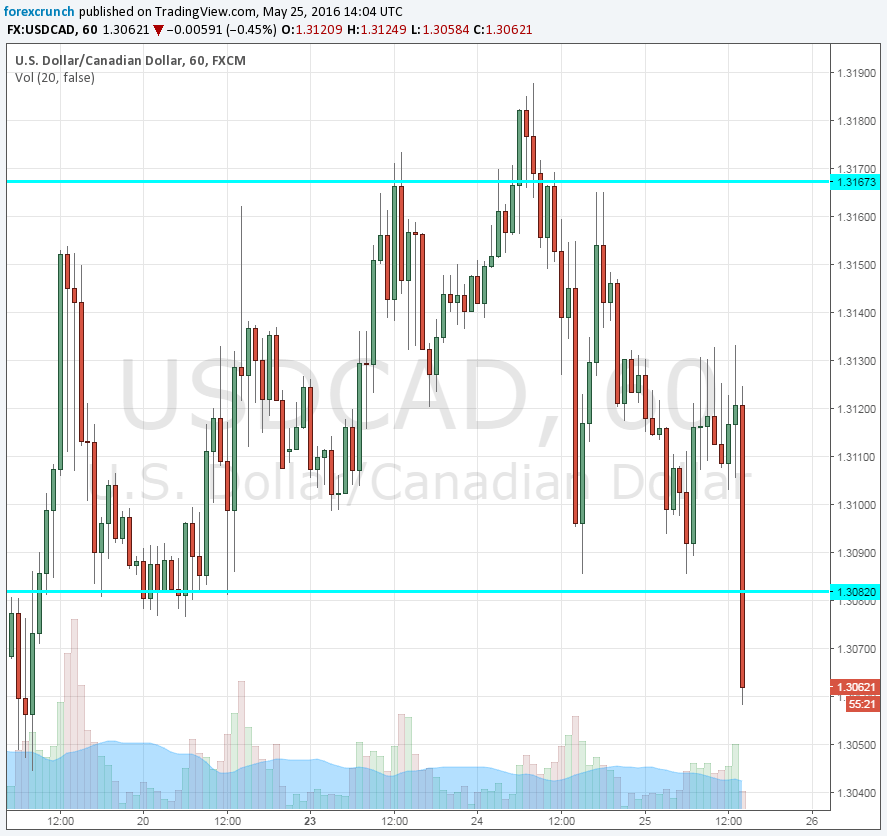

USD/CAD is moving to the downside, challenging support at 1.3080. Update: the pair extends its falls.

The Bank of Canada was expected to leave the interest rate unchanged at 0.50% also now, but perhaps sound a more cautious tone. Apparently this didn’t happen.

Up next: crude oil inventories (and US production) which always impact the Canadian dollar.

USD/CAD drifted in the 1.3080 to 1.13170 range, leaning lower towards the publication. The loonie enjoyed some love for commodity currencies in the past sessions.

Several things have changed in recent months that make things more complicated for the Canadian economy: the C$ returned to its strength (weighing on inflation and making exports less attractive), the wildfires in Alberta limit oil production and growth forecasts have dropped.

In the past, the BOC said that the real lower bound for rates is -0.50%, which is in negative territory, deeper than the 0.25% low rates reached after the financial crisis.

Here is the USD/CAD chart. The low so far is 1.3053. The next line of support awaits at 1.30 – a round number that also separated ranges. Further support awaits at 1.2930.