The Canadian dollar has been attempting a recovery, taking advantage of the greenback’s weakness. The loonie’s advance saw USD/CAD drop below 1.33 to a trough of 1.3286.

The price of oil giveth, and now the tankers taketh away. After a substantial rise during the week, crude is now falling off the highs. Markets were optimistic on the intentions of Saudi Arabia to curb production and like the drawdown in US inventories. However, every rally has a correction.

The Canadian dollar is also on the back foot also due to dovish words by Bank of Canada Senior Deputy Governor Carolyn Wilkins. She sounded cautious on the economic recovery after trade tensions halted investments. The BOC seems to be in no rush to raise rates anytime soon.

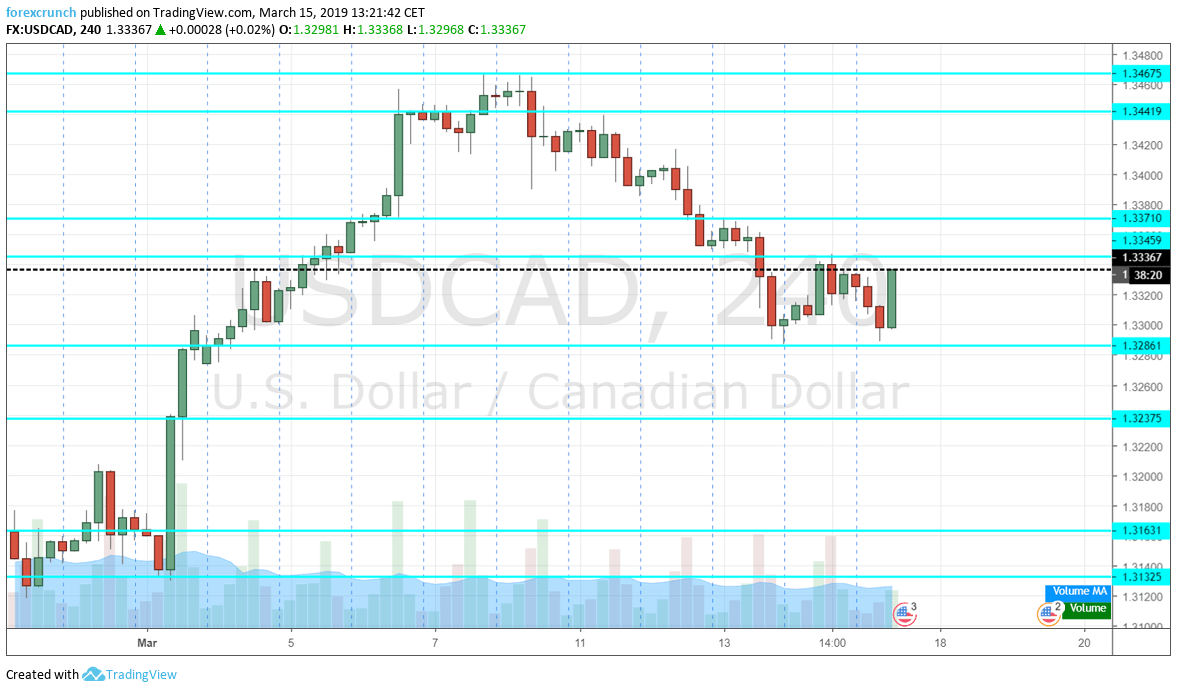

Dollar/CAD is back above 1.3300, and it is currently eyeing resistance at 1.3345 which capped it earlier in the day. Further resistance awaits at 1.33710 which held it down earlier in the week and then the high levels of 1.3420 and 1.3467, the latter seen last week.

Support awaits at 1.3286, the daily low, followed by 1.3237. The next lines, 1.3163 and 1.3112, are from early in March.