In our FED preview, we laid out three scenarios, only one USD positive. Here is the view from Deutsche Bank, which focuses on EUR/USD:

Here is their view, courtesy of eFXnews:

A Fed rate hike at the Dec FOMC meeting is a foregone conclusion. The market has already leapt ahead and is focused on the forward looking aspects of the FOMC news flow: the dots; the economic forecasts; and the indications from Janet Yellen, on how much weight the FOMC puts on ‘animal spirit’ inspired growth, and prospective fiscal expansion

Specifically on the dollar, it will be curious to see what she says about the dollar now as compared to past periods when the USD has been strong. The evidence for the strong USD tightening financial conditions is much less compelling compared to early this year, when the dollar was impacting all of commodities, high yield credit, and China, in ways that had a clear negative feedback to US growth.

All in all, we would be very surprised if anything we see from the FOMC leads to a sustained sell-off in the USD, even if there could be some minor buy the rumor sell the fact response in the immediate wake of the rate hike.

Similarly, it would be surprising to see the Fed say anything that stops a bullish US equity market in its tracks, especially now that the 2300 ‘target” on the S&P is firmly in sight.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

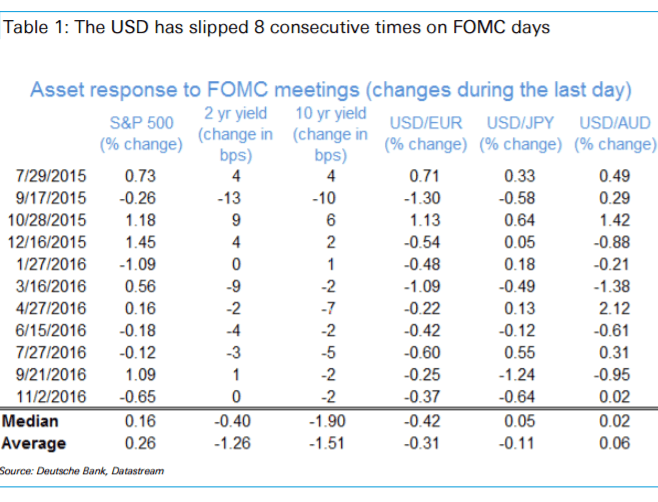

On the day of the last five FOMC meetings, the 10y yield has slid. The Fed has tended to err dovish in most meetings this year. Similarly, the USD has been weaker versus the EUR on every FOMC meeting decision day since the December hike last year.The dot plot will likely dictate whether that will change.

In any event, this is a currency market settling into the holiday spirit, but still apt to sell EUR/USD in the 1.07s with some gusto, only to take profits in the mid 1.05s.

EUR/USD will likely break the cycle lows at 1.0458 in coming weeks, but there is little expectation that the Fed will kick the EUR through this key level on Wednesday.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.