Inflation in Canada is going nowhere fast: CPI is only up 0.1% m/m and core CPI is flat. Year over year, CPI is up 1.4% and core CPI stays unchanged at 0.9%. Retail sales are up 0.4% but on top of a downward revision. Core sales are at 0.2%, and top of a downward revision, and this is not so encouraging, to say the least.

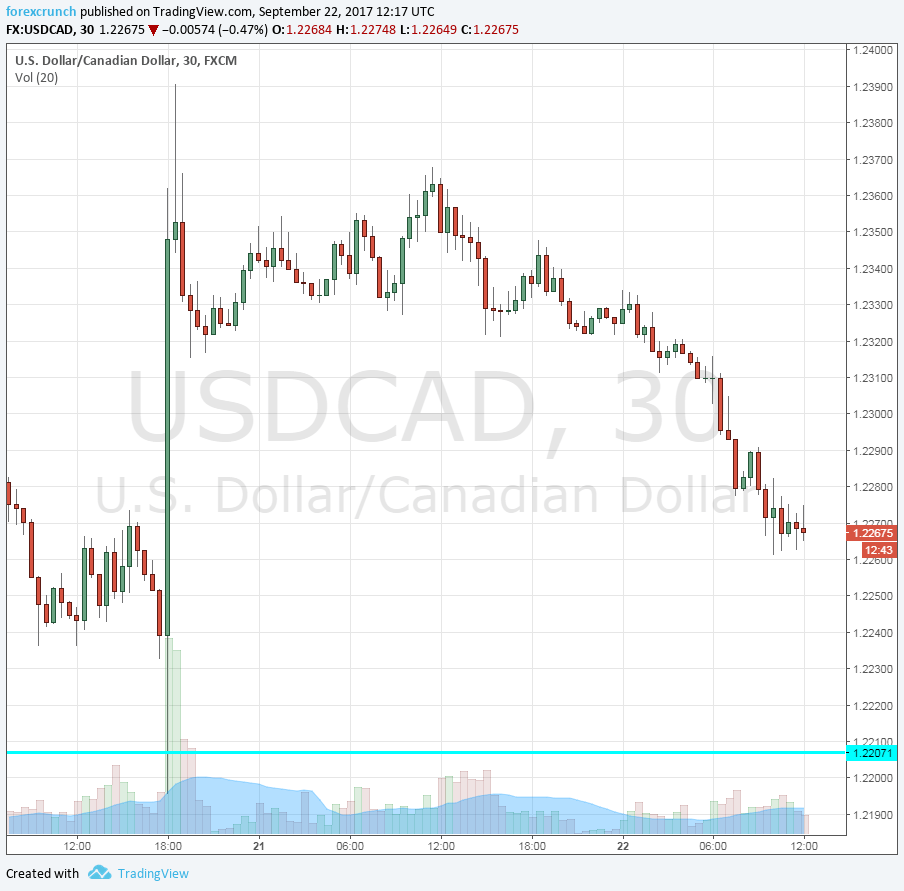

USD/CAD jumps from the lows to above 1.23. The high so far is 1.2318 but the pair is hesitating. Nevertheless, the gradual slide that the pair experienced came to a halt.

Canada was expected to report a rise of 0.2% in headline inflation in August, after 0% in July. Other measures of CPI have been ticking up gradually. Year over year, CPI was predicted to rise by 1.5% after 1.2%. Core CPI stood at only 0.9% y/y. The Bank of Canada has been forecasting higher inflation due to robust growth.

Retail sales were expected to rise by 0.2% in July after 0.1% in June. Core retail sales were predicted to rise by 0.4% after 0.7% in June.

USD/CAD was sliding ahead of the publication, around 1.2265. The Canadian dollar has been clawing back its losses that were the result of the hawkish Fed decision.