No surprises with Canada’s GDP: a rise of 0.1% month over month. Producer prices in Canada jumped by 1.1% m/m, much more than 0.4% predicted but remained negative at -1.1% y/y.

USD/CAD remains stable.

The Canadian economy suffered from the fall in oil prices but the economy is quite diverse. There are worries about the bubbling housing sector in a few cities.

Canada was expected to report a growth rate of 0.1% in April 2016 after a drop of 0.2% in March. The country is unique in publishing GDP on a quarterly basis. In this specific release, we get a peek into Q2.

USD/CAD traded around 1.2955 ahead of the publication. The US releases weekly jobless claims at the same time.

Dollar/CAD has been influenced by Brexit: the US dollar advanced on safe haven flows and the C$ slipped on risk averse markets. However, the move was not that strong in this pair, compared with others.

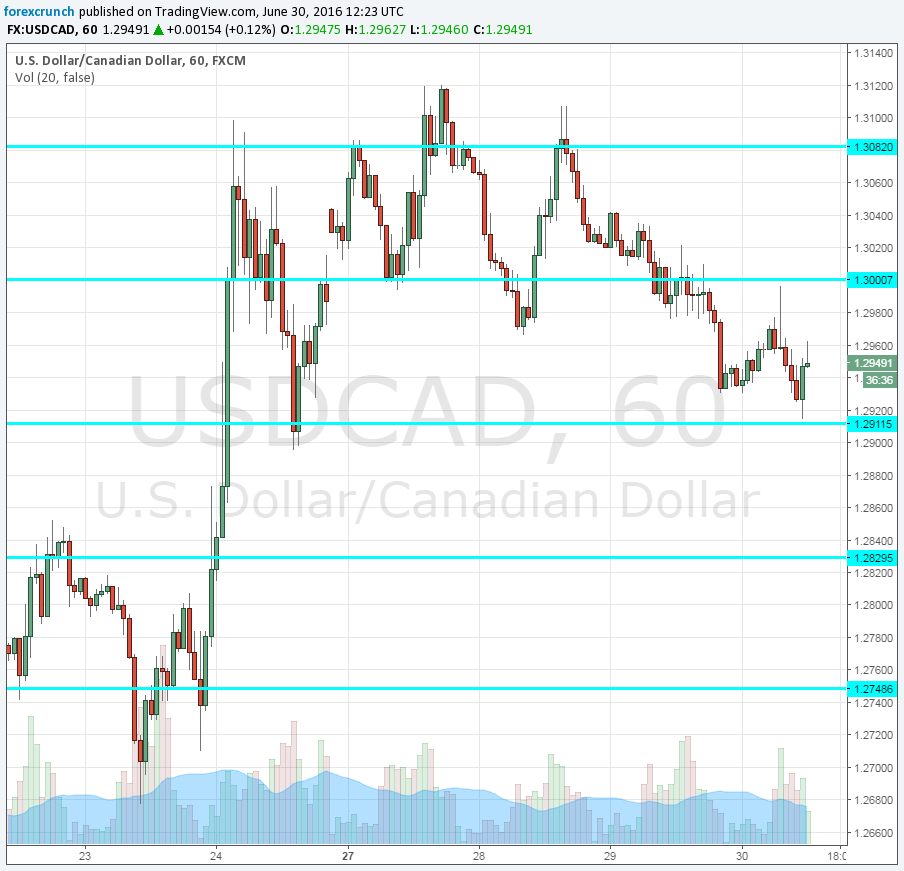

Here is the USD/CAD chart. The range is quite clear: 1.2910 to 1.30. Further support awaits at 1.2830 and 1.2750. Resistance is at 1.3080.