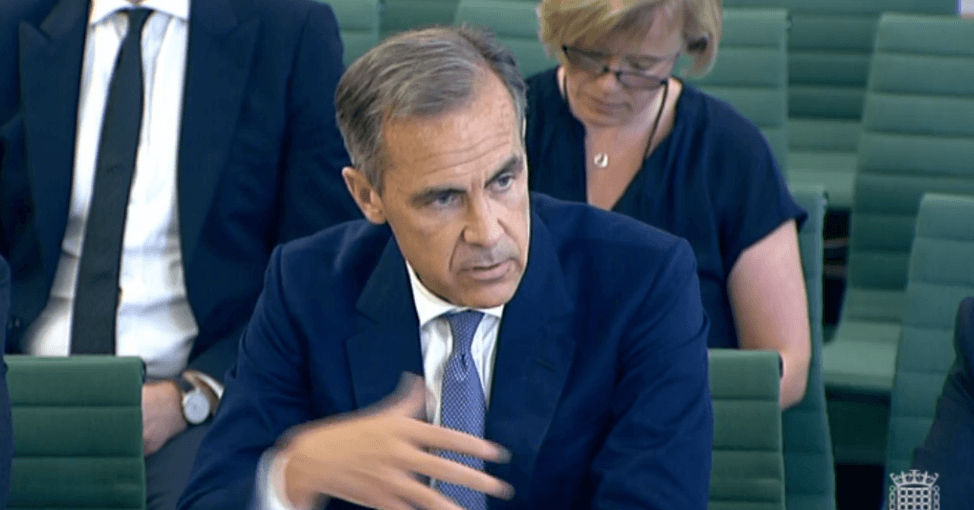

BOE Governor Mark Carney and some of his colleagues are testifying in the Inflation Report Hearings in London. The opening statements discussed the better than expected data and the role of the “Old Lady” in the scaring ahead of the referendum.

Carney rejected the accusations, saying that the forecasts are the Bank’s best judgements and that he does not regret the significant monetary stimulus package. The stimulus supports business investment, real estate lending and financial markets in general. The Canadian does not regret the contingency measures which helped cushion the shock.

He is also “serene” about the statements made before the vote and that there is still high uncertainty regarding Brexit. He clarifies that he did not forecast a severe recession.

He was expected to be scrutinized about the comprehensive stimulus package, about painting a gloomy picture before and after the referendum and about future policy.

The BOE leaves the door wide open to further monetary stimulus if needed and that the institution is ready to make adjustments. Cable holds on to support at 1.3360. A further cushion awaits at 1.3250. Resistance awaits at the post-Brexit high of 1.3480.

All in all, there are no significant market moving statements here. On the political front, there are no shocks either: the BOE pats itself on the back.

Other statements from Carney, as well as his colleagues, also talk about calming the markets and perhaps cutting rates in November.

GBP/USD traded around 1.3370 before the event, partly due to the mediocre manufacturing data released earlier.