Markets are slow, trapped in small corrective waves that could result in an even weaker USD in the sessions ahead. On the EURUSD hourly chart we are tracking a corrective wave B) down that appears incomplete as we need a three wave decline from the latest high. So the current minor recovery can be a subwave B so wave C down could be coming. A fall close to 1.0760/1.0820 may not be a surprise, maybe even a long opportunity if we get there. I will keep a close eye on that one.

EURUSD 1h Elliott Wave Analysis

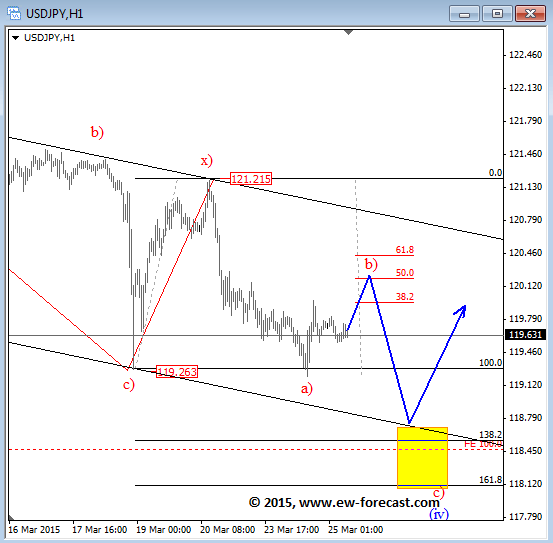

USDJPY spiked beneath 119.26 yesterday before it turned up, probably into a corrective wave b) that we already highlighted in recent updates. As such, upside can be limited near 120 as we see ongoing price down in a second zigzag that can be looking for a drop to around the 118.00/118.50 area, a potential bounce zone.

USDJPY 1h Elliott Wave Analysis

In our latest podcast we discuss The Fed and the road ahead – all you need to know

Subscribe to Market Movers on iTunes