- EUR: The M3 money supply data is rarely a market mover, but does offer lots of detail on lending and borrowing within the Eurozone, so this will be of background interest. Focus also on Italian confidence data as well as the impact from the opening of the banking sector in Cyprus after nearly two weeks of being closed (including stock exchange). Deadline for Bersani to form a government in Italy as well.

- GBP: Just data on services sector output for January, but is rarely a major event for markets so volatility risks are low.

- JPY: Early on Friday both labour market and inflation data are released. These are the last major releases before the Bank of Japan meeting next week, so the market may well be more sensitive to the data than usual.

Idea of the Day

We reach the last full trading day for the current quarter, with many markets closed tomorrow for Good Friday. At the institutional level, this will mean further position adjustment into the end of the month and with it, more volatility on the main FX pairs.

The two themes that pressured the euro yesterday will also bear down on sentiment, namely events in Cyprus (banks re-opening today, with restrictions) and the lack of a viable government in Italy. Today is the deadline for Bersani to form a government, but the options are now limited, creating renewed uncertainty for markets and keeping volatility high.

Latest FX News

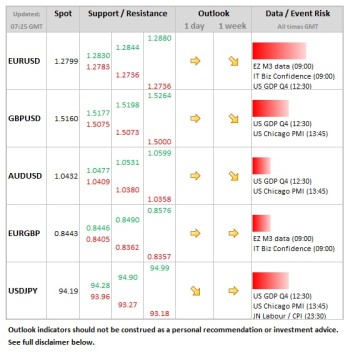

- EUR: For most of Wednesday the single currency was under pressure from the events of the week, but more so from the deterioration of sentiment in Italy as the prospects of a government forming in the wake of last month’s took a turn for the worse, forcing peripheral bond yields higher and sending euro lower, to new low for the year at 1.2751.

- GBP: GfK consumer confidence data overnight shown steady at -26, with Nationwide house prices rising on YoY basis from 0.0% to 0.8%. Neither release impacting the currency, so month-end flows are likely to dominate ahead of the long weekend.

- JPY: Last day of current fiscal year, could lead to yen weakening next week, as repatriation flows reverse. Naturally, there is a big focus on Bank of Japan meeting as well.

- AUD: Private sector credit growth data in line at 3.4% (vs. 3.6%), whilst job vacancies for the quarter fell 10.1%. AUD still holding firm above 100d moving average at 1.0409.