- The Dollar Index remains under pressure in the short term. As a result, a new lower low may signal more declines.

- The index has taken a hit from the US Industrial Production, which has worsened than expected.

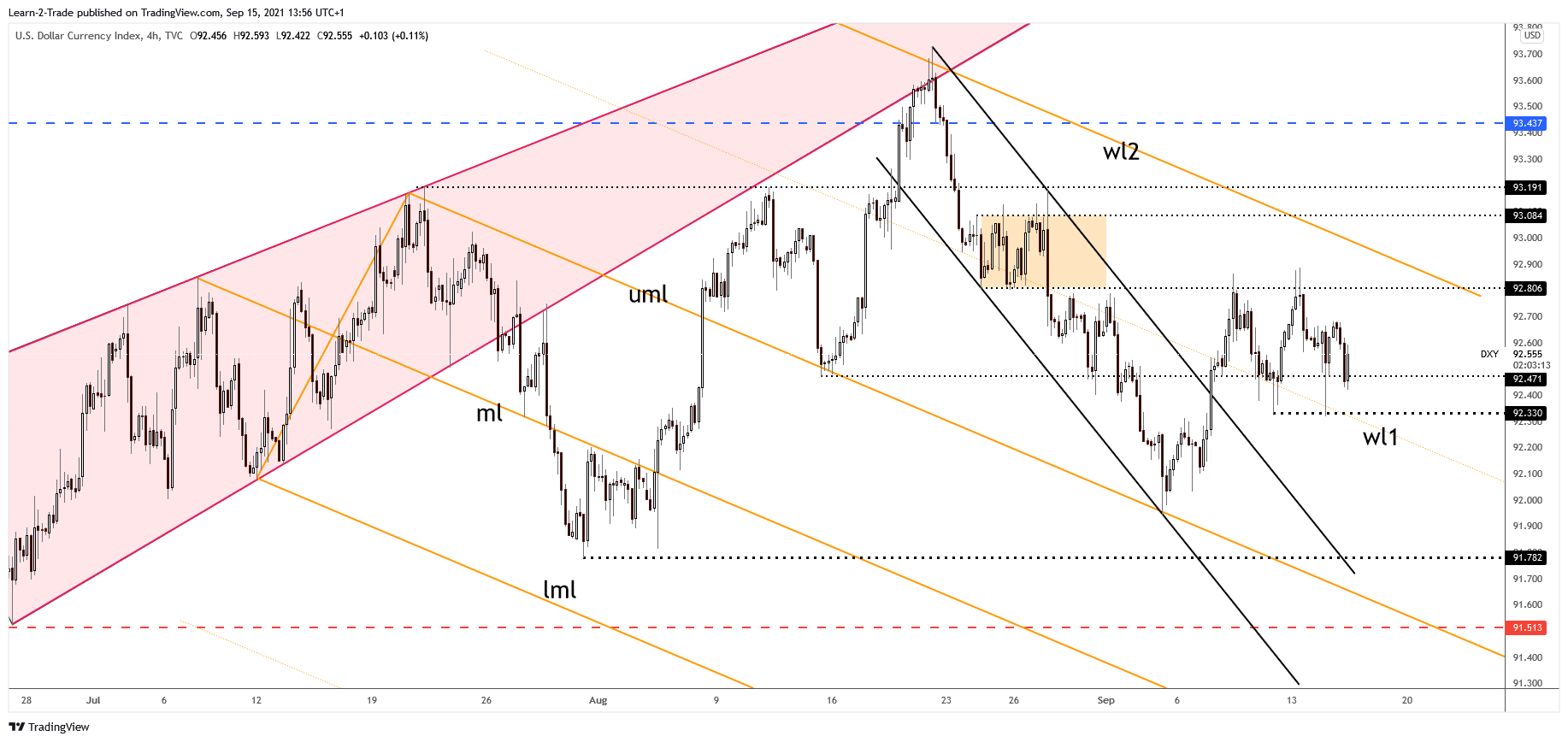

- A valid breakout above the second warning line (wl2) may bring a broader leg higher.

The DXY Dollar Index price rebounded in the short term, trying to stay above the 92.47 static support. However, it remains to see what will really happen as the index moves sideways within a narrow range. Technically, a clear direction will be brought only by a valid breakout from this pattern. Fundamentally, the index has started to increase after the Canadian inflation figures were published and ahead of the US data.

-Are you looking for automated trading? Check our detailed guide-

Canada’s Consumer Price Index rose by 0.2% in August versus 0.1% growth expected after a 0.6% rise in July, while the Core CPI registered a 0.2% growth. Unfortunately for the DXY, the US data came in mixed a few minutes ago. The index is melting down after Industrial Production reported a 0.4% growth in August versus 0.5% expected compared to 0.8% reported in July.

We should wait to see how the DXY reacts after the US data dump. For example, the Capacity Utilization Rate jumped from 76.2% to 76.4% beating the 76.3% estimate, while the Empire State Manufacturing Index rose unexpectedly higher, from 18.3 points to 34.3 points, exceeding the 18.1 points forecast.

DXY Dollar Index price technical analysis: Range formation

The Dollar Index is trapped between the 92.80 and 92.33 levels. It continues to pressure the 92.49 static support. Yesterday’s false breakdown with great separation through this level signaled that the DXY may gain back highs.

-If you are interested in forex day trading then have a read of our guide to getting started-

Though, the pressure remains high after the United States inflation data have disappointed. Therefore, we cannot exclude an extended sideways movement. However, as you already know from my analysis, the Dollar Index may develop a broader upwards movement only after a valid breakout through the second warning line.

On the other hand, a larger drop might be activated only by a valid breakdown below 92.33 and under the warning line (wl1). This scenario may signal that Greenback probably lose significant ground versus its rivals.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.