- Ethereum bullish but runs out of steam for recoil above $200.

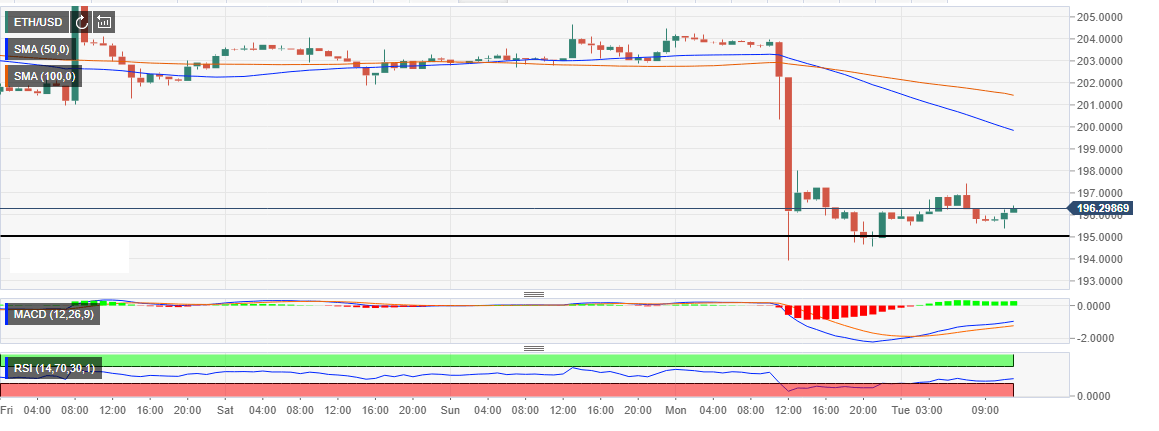

- Both the 50 SMA and the 100 SMA will limit gains above $200.

The market is struggling to stay above $200 billion, although the market cap currently stands at $203 billion. The slight declines yesterday saw most of the top 20 digital assets correct lower below key support areas. The $20 billion crypto, holding the second position in the market is trading at $196. Ethereum has a 24-hour trading volume of $1.4 billion with most of its trading activity taking place on DOBI trade and Bithumb.

Trading signals for traders using technical indicators are positive. Ethereum, alongside other digital assets have resumed the upside trend. However, the bulls are still in hibernation hence the slight recovery progress on the day. The drop on Monday saw Ethereum break the support at $200. Fortunately, the nest support at $195 held ground preventing more losses heading to the previous support area at $190.

At press time, ETH/USD gains have been capped at $197. Ethereum is currently stuck in range with the lower limit at $195. If the bulls manage to escape the bear range, they then face resistance at the 50 SMA currently at $200 before battling with the sellers at the 100 SMA currently at $201.

The MACD signal line is still in the negative region but making advances towards the mean level. The RSI is slowly heading north showing that the bulls are likely to continue increasing their entries in the short-term. A move that could see ETH/USD reclaim the support at $200.

ETH/USD 60-minutes chart