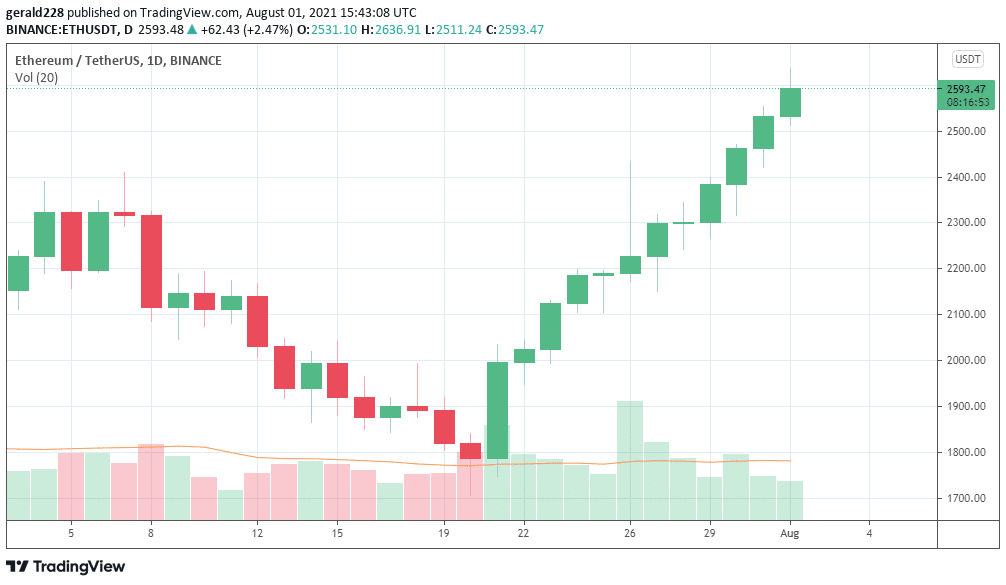

The Ethereum price is on a roll over the past 24 hours with new resistance levels being breached. ETH is currently trading at the $2600 level which represents its next level of resistance after having breached the $2400 mark quite easily.

Although there could be small retracements along the way, the path appears to be clear for Ethereum to continue scaling new levels and perhaps even targeting the $3000 level in the immediate short term.

The cryptocurrency market seems to be gripped by positive sentiment all around and Ethereum is certainly no exception. Institutional investors seem to have returned to the market and the ease with which Ethereum sailed through the psychologically significant $2400 level is an indication of more strength in this sector.

If you haven’t yet bought some Ethereum, then this How To Buy Cryptocurrency Beginner’s Guide would be a good place to start.

Short Term Forecast For Ethereum Price: The $2900 Level Is The Next Barrier

Ethereum is up by a staggering 30% from its July 20 low of $1700 having traded at over the $2600 level over the past 24 hours. Bullish momentum appears to have entered the market in a big way and the Ethereum price is a reflection of this. It has risen consistently every day for a period of 11 days and shows no sign of stopping.

It seems that bears have disappeared from the market, at least for now. A bullish thesis would mean that the ETH price would continue its uptrend and make a beeline for the $2900 mark. This would be an 11% increase from the current price. Although the daily chart appears to be lacking a follow-through momentum, bears seem to be mysteriously absent from the market.

If bears do come in, then one would expect a 10% drop to below the $2400 mark after which the $2100 levels could again be retested. However, that scenario does look unlikely as bullish strength seems to be prevailing as in most of the crypto market.

If you haven’t yet bought some cryptocurrency then it would be a good idea to take a look at these Best Cryptocurrency Brokers.

Long Term Forecast For ETH: Bulls Are Back In Town

Although there remain some downside risks with regards to Ethereum, the general outlook seems to be a bullish one. It seems that bulls have defied the much-vaunted death cross and sailed above the $2500 mark to tackle the $2600 level.

The next step for Ethereum would now be the $2900 level after which a strong buying spree could take it all the way up to the $3300 level. This would be an 11% appreciation from its current price. Long term, Ethereum seems to be showing a lot of strength and by the end of the year, the $4500 level need not be out of the question.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk