EUR/USD isn’t going anywhere fast, and certainly lost its upside momentum, at least for now. The team at Credit Agricole explains the factors moving EUR/USD and sees potential downside:

Here is their view, courtesy of eFXnews:

The EUR has been under pressure for most of last week, mainly in reaction to this week’s terrorist attacks in Brussels and rising Fed rate expectations.

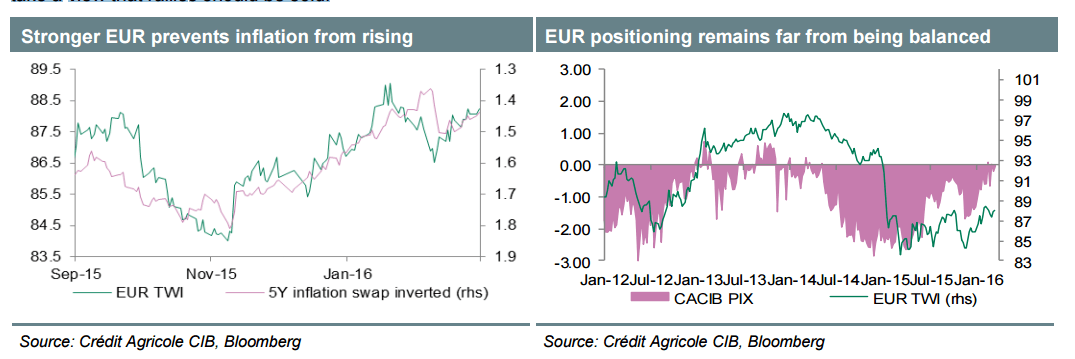

Elsewhere, it must be noted that medium-term inflation expectations as measured by 5Y inflation swaps failed to improve over the last few weeks, irrespective of the ECB having eased monetary policy further. Even if the central bank intends to become less dependent on market driven developments, it appears that the stronger EUR has been preventing inflation expectations from rising.

However, we remain of the view that the central bank is unlikely to become more aggressive anytime soon. This is especially true as more time is needed in order to evaluate the impact of the latest policy steps on the economy.

From that angle the single currency should be driven still by external factors such as Fed rate expectations and risk sentiment. We continue to take a view that rallies should be sold.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.