One of the drivers of the euro has been, well, bad news. The euro worked as a safe haven currency. However, Draghi already degraded the euro and now there are more developments.

The team at Credit Agricole explains:

Here is their view, courtesy of eFXnews:

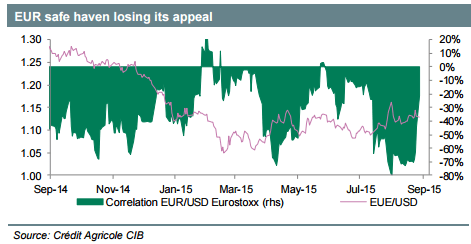

The recent price action in EUR suggests that the negative link between the single currency and the European equities maybe softening. Indeed, the 1M correlation between EUR/USD and Eurostoxx index, while still negative, has now bounced off the summer lows. Understanding the negative correlation helps explain the EUR’s resilience. In particular, it seems driven by investors’ unwinding of longs in EZ stocks and EUR-shorts that were used to hedge the asset exposure. The latest price action would suggest that a sizeable chunk of the EUR-shorts have been taken off the table, consistent with the latest sharp reduction in the speculative market shorts in EUR/USD (using CFTC data).

The correlation between EUR/USD and risk appetite can turn even less negative from here given that short-EUR hedges have become less attractive because EUR/USD was largely drifting higher after hitting a multi-year low in March.

This could diminish the EUR’s safe-haven appeal and allow other FX drivers play a greater role than before. In particular, we expect that the relative policy outlook could become a dominant force behind EUR/USD and EUR/GBP, pushing them lower yet again in the near-term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.