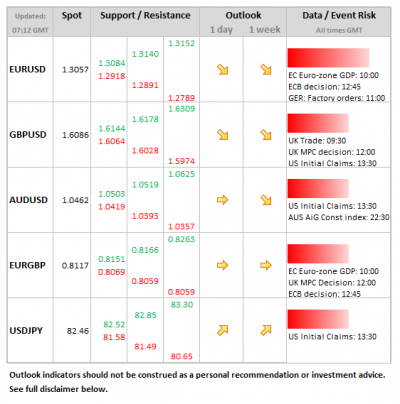

- EUR: Plenty of economic event risk today, with eurozone GDP at 10:00, German factory orders at 11:00, and the ECB announcement at 12:45 (followed by press conference at 13:30). GDP the most important, as it may affirm that the eurozone is in a deeper recession than expected. If so, euro may retreat further.

- GBP: Other than trade figures at 09:30, focus today will be on dissecting yesterday’s Autumn Statement. OBR reminder yesterday that growth will be non-existent for a while yet. Not great for the currency.

- USD: Fiscal cliff impasse on-going, although just occasionally there is some brightness amongst the dark clouds. Otherwise, dollar is watching data and aware that Fed will likely opt for more asset purchases when it meets next week. Economic data likely to be volatile due to effects of SuperStorm Sandy.

Idea of the Day

After three weeks of gradual buying, the euro ran into a wall of sellers above 1.31 yesterday. Technically this is a critical time for the single currency. It is possible to argue that it has made a series of lower highs this year – February 24th at 1.3487, March 27th at 1.3386, May 1st at 1.3284, September 14th at 1.3169, October 17th at 1.3140 and December 5th at 1.3127. Some technical indicators are suggesting the euro could be a little top-heavy up here.

Latest FX News

- USD: Has suffered recently because of likelihood of more asset purchases and continuing intransigence by both parties re fiscal cliff. Also, euro short-covering has weighed on the dollar. Did better yesterday as euro ran into stern resistance.

- GBP: No real surprises from the Chancellor. British austerity will be with us for a while yet: extra revenue to come from the rich and famous, those approaching retirement and welfare recipients. Will spend big on schools and roads, although proof will be in the pudding. Sterling relatively unmoved.

- EUR: In retreat yesterday amidst determined selling interest above 1.31. Spanish yields soared after report that Spain wants ECB assurance that bond spreads will remain < 200bp if it applies for aid. ECB unlikely to provide such a guarantee. No wonder bond yields and euro softened.

- GOLD: Another rough day for everyone’s favourite precious metal, falling to a fresh four-week low under USD 1,690. Some suggestion both gold and Apple (amongst other widely-held stocks) are declining because of hedge fund liquidation.

- AUD: Employment stronger than expected, although full-time jobs fell. Unemployment rate much lower than expected at 5.2%. Aussie little moved.

Further reading: US recession already in play? One lone voice continues insisting