- EUR/USD has advanced after Moderna reported progress in developing a coronavirus vaccine.

- Uncertainty about the EU Fund, US COVID-19 cases, and other factors may limit gains.

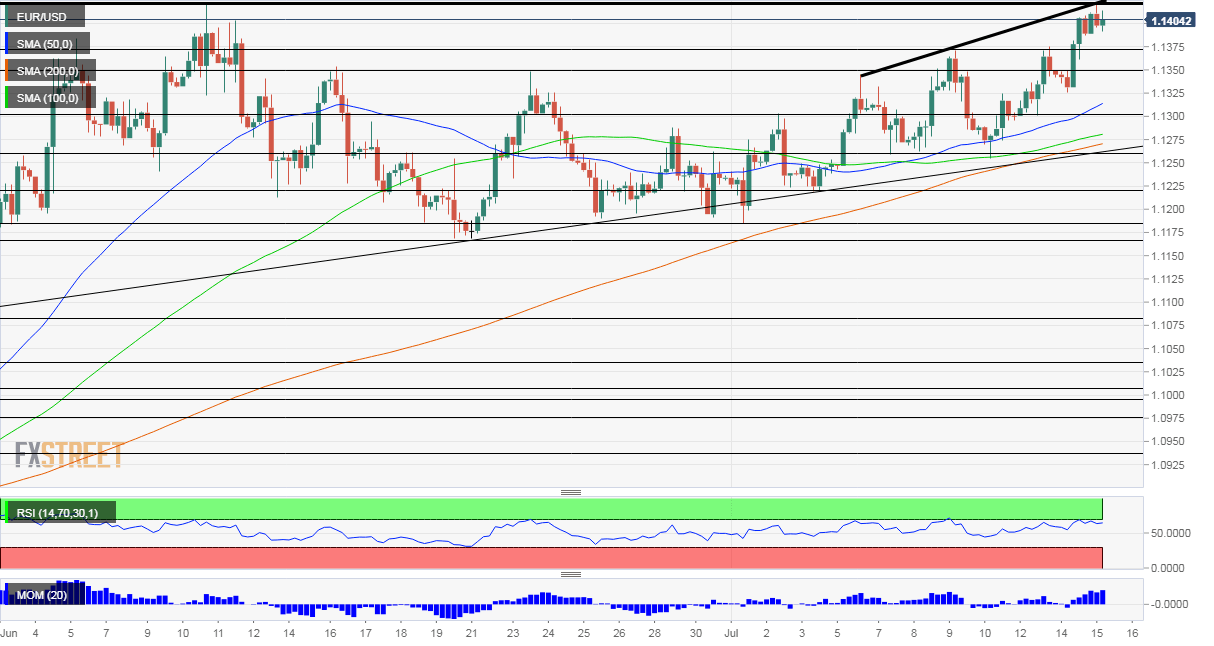

- Wednesday’s four-hour chart is showing the pair is at a critical juncture.

“Robust immune response” – these words used by Moderna to describes its progress on developing a coronavirus vaccine lifted stocks and weighed on the safe-haven dollar. For EUR/USD, it means a challenge of high resistance.

Massachusets-based Moderna is moving markets up, and not for the first time. The highly-regarded New England Journal of Medicine reported that the pharma company’s test produced neutralizing antibodies – four times more than in recovered patients – among the 45 human subjects and with little side effects.

Equities are torn between such promises for a rapid solution to COVID-19 and reality – which remains grim in several US states. California, which imposed a sweeping lockdown, hit a record number of cases, and so did Texas, which took only minor steps.

Total US infections have surpassed 3.6 million, and deaths topped 136,000. Mortalities are on the rise. The seven-day rolling average of new deaths million is here:

Source: FT

Updated coronavirus statistics will be of interest later in the day.

Recent US data has been satisfactory, with the Core Consumer Price Index (Core PCI) rising holding up at 1.2% in June, beating expectations. Wednesday’s calendar includes the Empire State Manufacturing Index for July and Industrial Production for June.

The most significant publication is on Thursday – Retail Sales for June. Last month kicked off with rising expenditure amid reopenings, but then suffered a downturn as COVID-19 cases soared.

In the old continent, the disease remains under control despite several local flareups. The focus is on deliberations between EU members on the proposed recovery fund. German Chancellor Angela Merkel hosted Spanish Prime Minister Pedro Sánchez on Tuesday and said she is willing to compromise to get the deal over the line.

Spain and Italy are staunch proponents of the ambitious program – which includes €500 billion in mutually funded grants. Opposition comes from the “Frugal Four” – a group of rich nations led by the Netherlands. Investors still expect a compromise that will be good enough to help the eurozone recover.

The European Central Bank meets on Thursday and will likely leave its policy unchanged while pressing leaders to approve the fund.

See ECB Preview: EUR/USD depends on Lagarde’s fearless nudging of the Frugal Four

Markets have brushed aside Sino-American tensions. President Donald Trump has ended Hong Kong’s special status in response to China’s tighter grip on the city-state. Nevertheless, the world’s largest economies continue to uphold the trade deal.

Overall, coronavirus hopes and fears are prominent factors moving EUR/USD.

EUR/USD Technical Analysis

Euro/dollar is trading below and uptrend resistance line that has been accompanying it since early July. That line now converges with 1.1425 – the currency pair’s peak in early June. Breaking above this critical resistance line would open the door to the highest levels since March.

Momentum on the four-hour chart is to the upside and EUR/USD is trading above the 50, 100, and 200 Simple Moving Averages. The Relative Strength Index is below 70 – thus outside overbought conditions.

All in all, bulls are in control.

Resistance above 1.1425 is at 1.1495, March’s peak, and then 1.1560. Support awaits at 1.1375, a stepping stone on the way up, followed by 1.1350, a swing high from early in the month. The next levels at 1.13 and 1.1265.