- EUR/USD has been ticking higher as attention moves away from Europe.

- German inflation and the Fed decision are eyed for action.

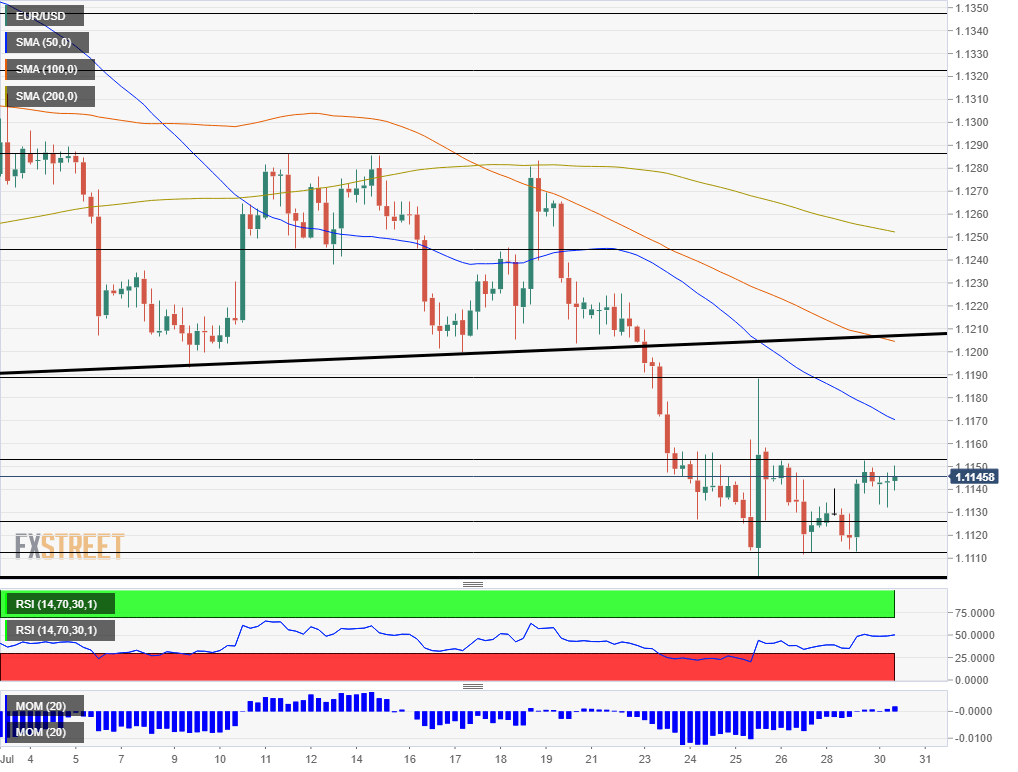

- Tuesday’s four-hour chart is showing an improving environment for the bulls.

When Europe is out of the news – EUR/USD rises – and not for the first time. The common currency has been grinding its way higher as the old continent is out of the limelight and as markets focus on Boris Johnson’s Brexit, US-Sino talks, and the Federal Reserve

This phenomenon may be explained by the euro zone’s trade surplus and the American trade deficit which supports a higher EUR/USD exchange rate. Importers and exporters are now having their say as speculators – usually dominating price action – are moving their focus elsewhere.

The main attention grabber is UK PM Boris Johnson’s “turbo-charging” of preparations for leaving the EU without a deal and his refusal to meet his European peers if they maintain their rejection to renegotiate the Brexit accord. While the eurozone is also set to suffer from a hard Brexit, the economic damage to the UK will likely be far greater. The pound is crashing while the euro ignores.

Another reason for the calm comes from the Federal Reserve. The world’s most powerful central bank’s decision is due out on Wednesday and investors are refraining from taking risks at this point. The Fed is set to cut interest rates for the first time since the crisis but signal that no further action is due. EUR/USD is trading quietly ahead of the explosive event.

See Fed Preview: The currencies to trade in each of these four scenarios

Tension also surrounds US-Sino trade talks. High-level officials are meeting in Shanghai for the first time since early May. However, officials from the world’s largest economies have lowered expectations for an imminent breakthrough.

There is one significant event in the eurozone today – preliminary German inflation figures for July – that feed into Wednesday’s all-European number. However, it is important to note that the data come out after last week’s European Central Bank meeting and are thus of lower interest than usual.

Later in the US, the Core Price Consumption Expenditure (Core PCE) is set to show a minor acceleration in inflation. This indicator is the Fed’s preferred gauge of inflation, but it lags others. The Conference Board’s Consumer Confidence figure is also of interest.

See US Conference Board Consumer Confidence Preview: Happiness is relative or are your relatives happy?

All in all, the calm before the Fed storm may allow for further EUR/USD advances.

EUR/USD Technical Analysis

Momentum on the four-hour chart has turned positive and the Relative Strength Index has stabilized – both implying further small gains. However, the world’s most popular currency pair must cross the 50 Simple Moving Average – at 1.1170 at the time of writing – to convince more buyers to jump in.

Some resistance awaits at 1.1150 which has capped the pair this week. Above 1.1170, resistance awaits at Thursday’s post-ECB peak of 1.1190. Next, we find 1.1240.

Some support awaits at 1.1125, which was a swing low last week. It is followed by the double-bottom of 1.1111 and by the 2019 trough of 1.1101.