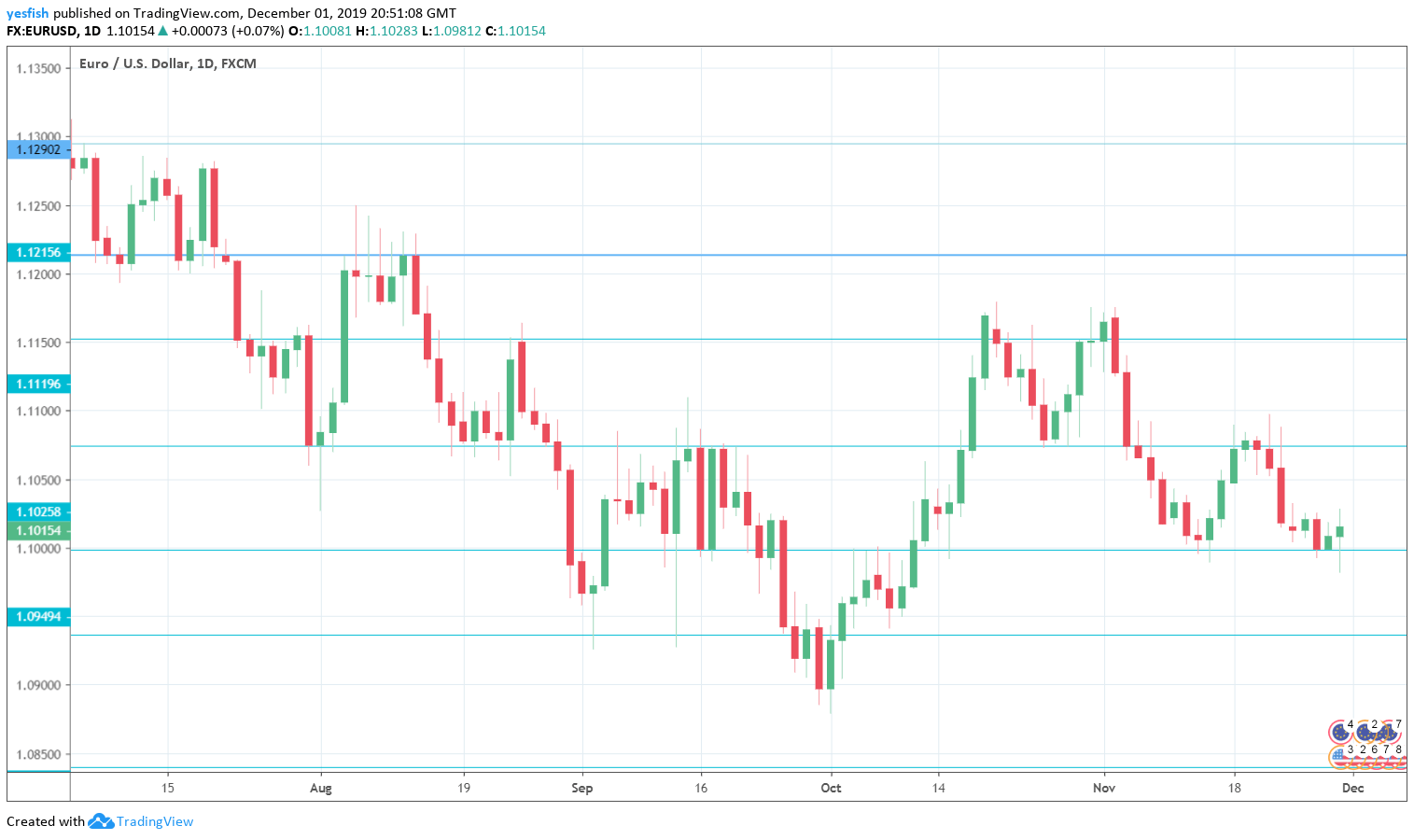

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. These Final PMI readings are expected to confirm in the initial releases in late November. Spain’s manufacturing sector has been in contraction mode for the past five months, and the trend is expected to continue in November, with an estimate of 46.5. In Italy, the manufacturing sector has been in decline for over a year and the forecast for the upcoming release is 47.5. The German indicator is expected at 43.8 and the eurozone PMI at 46.6 pts. France is the lone bright spot, with a forecast of 51.6 points.

- Spanish Unemployment Change: Tuesday, 8:00. Spain’s unemployment rolls jumped to 97.9 thousand in October, much higher than the estimate of 62.0 thousand. Another high reading is forecast for November, with an estimate of 75.2 thousand.

- Services PMIs: Thursday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services PMIs continue to outshine the manufacturing PMIs, with readings slightly above the 50-level, pointing to weak expansion. The PMI readings are expected to confirm the initial readings from November.

- German Factory Orders: Thursday, 7:00. Factory orders rebounded in September with a gain of 1.3%. This followed back-to-back declines. The forecast for October stands at 0.5%.

- Revised GDP: Thursday, 10:00. Third-estimate GDP is expected to show a gain of 0.2%, confirming the first and second estimates. This points to weakness in economic activity in the eurozone.

- German Industrial Production: Friday, 7:00. Industrial production declined by 0.6% in September, its third decline in the past four readings. The markets are predicting better news in October, with an estimate of +0.2%.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1390 has held firm in resistance since June. This is followed by1.1345.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 (mentioned last week) switched to resistance in early November.

1.1025 remains relevant and is currently an immediate resistance level. 1.0925 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I am bearish on EUR/USD

The U.S. economy continues to outperform that of the eurozone, and the euro continues to flirt with the symbolic level of 110. The German locomotive is also showing signs of strain, and the euro could face pressure.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!