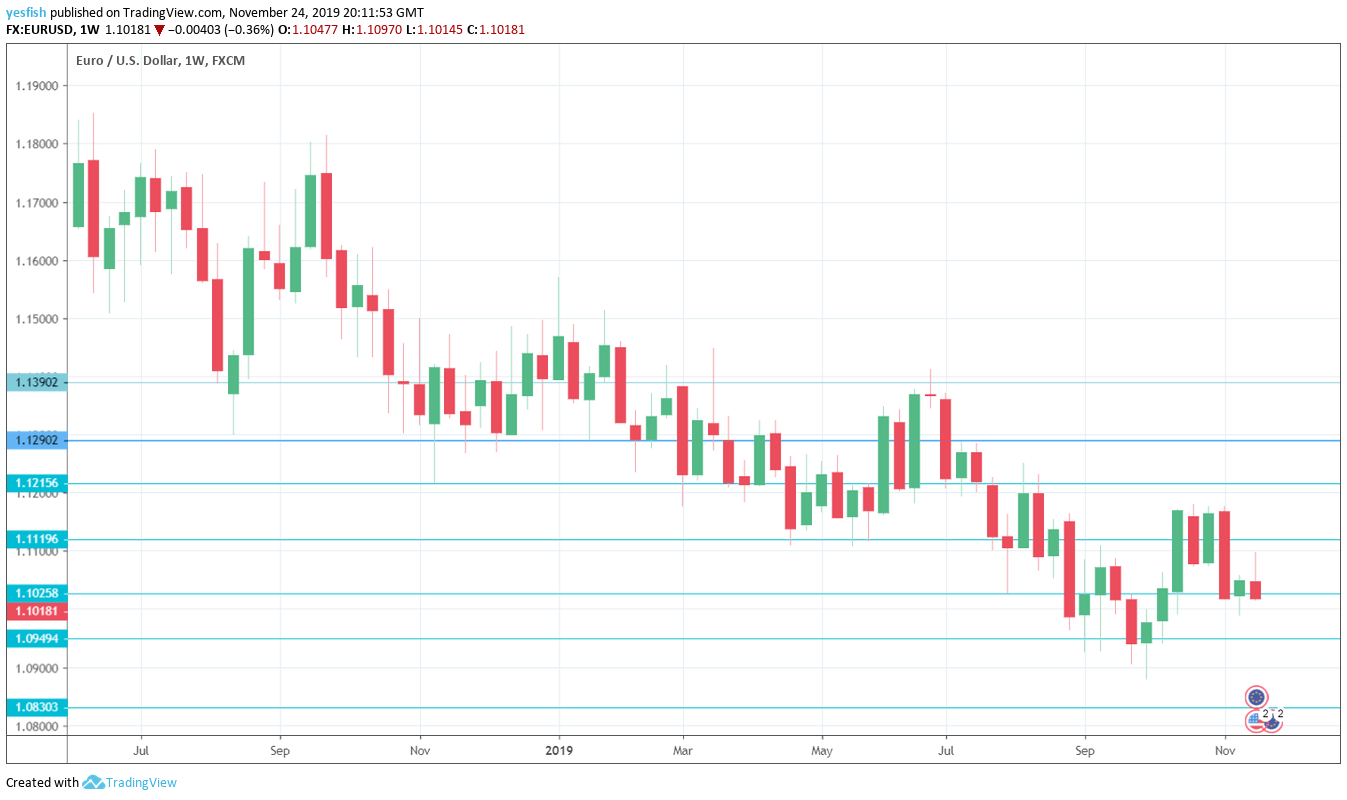

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 9:00. The indicator has posted two straight readings of 94.6 pts. A slight improvement is expected in November, with an estimate of 94.9 pts.

- German GfK Consumer Climate: Tuesday, 7:00. Consumer confidence slipped to 9.6 in October, down from 9.9 points a month earlier. This was the lowest figure since February 2016. Little change is expected in November, with an estimate of 9.7 pts.

- German Preliminary CPI: Thursday, All Day. The German locomotive has slowed down, and this has been reflected in weak inflation numbers. Final CPI for October came in at 0.1% and the initial estimate for November stands at -0.7%.

- Monetary Data: Thursday, 9:00. M3 Money slipped to 5.5% in September, down from 5.7% a month earlier. Another gain of 5.5% is projected in October. Private Loans have been pegged at 3.4% for three successive months. The forecast for October stands at 3.5%.

- French Preliminary GDP: Friday, 7:45. The initial release for Q2 GDP showed a gain of 0.3%, just above the estimate of 0.2%. This figure is expected to be confirmed in the second estimate.

- Inflation: Friday, 10:00. Final eurozone CPI for October came in at 0.7%. The initial estimate for November stands at 0.8%. For the core figure, final CPI came in at 1.1%, while the estimate for the initial estimate in November is slightly higher, at 1.2%.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1390 has held firm in resistance since June. 1.1345 is next.

1.1290 was last tested in early July. This is followed by 1.1215.

1.1119 (mentioned last week) switched to resistance in early November.

1.1025 is an immediate resistance level. 1.0925 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I am bearish on EUR/USD

The U.S. economy continues to outperform that of the eurozone, and the euro has dropped close to the symbolic level of 110. If EUR/USD falls below this line, investors could react negatively and the decline could continue.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!