- Employment change in the US came in higher than expected in September.

- The Fed is set to continue its aggressive policy as the labor market remains tight.

- Investors will monitor US inflation data for clues on the Fed’s next move.

Today’s EUR/USD forecast is bearish. The US dollar gained strength versus a basket of global currencies after US data showed employers hired more workers than anticipated in September.

-If you are interested in forex day trading then have a read of our guide to getting started-

Indicating the Federal Reserve will likely continue its current aggressive tightening stance. After an unrevised 315,000 jobs in August, nonfarm payrolls climbed by 263,000 jobs last month, and the unemployment rate decreased to 3.5%, indicating a tight labor market.

“The labor market isn’t just rolling along. It’s a virtual steam-roller that does nothing to slow economic demand and help the Fed in its inflation fight,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

Several Fed officials reaffirmed the idea that interest rates will continue to rise as the institution works to control inflation and that it is far from done raising rates. This could mean darker days ahead for the EUR/USD as the dollar continues rising.

According to strategists, the release of US inflation data this week will also be widely monitored and could impact how investors view the Fed’s monetary policy.

The US central bank increased its policy rate from near zero at the beginning of this year to the current range of 3.00% to 3.25%, and last month it indicated that significant additional hikes might be coming this year.

EUR/USD key events today

Investors will pay attention to a speech from Philip R. Lane, a European Central Bank’s Executive Board member. His speeches frequently give hints about the potential future course of monetary policy.

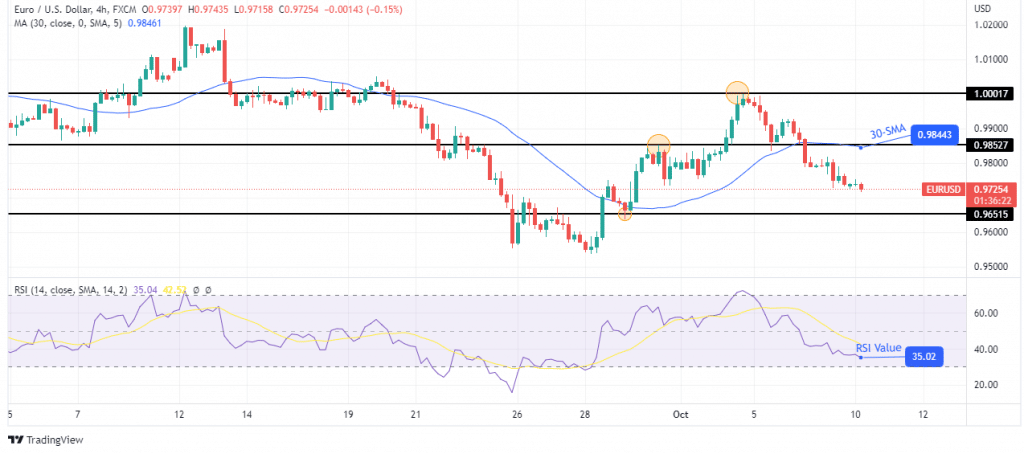

EUR/USD technical forecast: Bearish bias returns as the price trades below the 30-SMA

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50. This shows that bears are in control of the market. Bears took over at the 1.0001 key psychological level, pushing the price below the support zone of the 30-SMA and the 0.9852 support level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Below this zone, bears are eyeing the 0.9651 support level. They will likely break below this level and start making new lows if they maintain their momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.