- EUR/USD has been grinding higher slowly after finding a bottom at 16-month lows.

- US Treasury yields are weighed down by inflation expectations and US housing numbers.

- Reflation fears are tamed by ECB policymakers.

- Intraday traders will be entertained by Fed and ECB speeches.

The EUR/USD price forecast is mixed at the moment as the pair bounced off from the lows but still remains weak to attain an upside momentum.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Early Thursday, EUR/USD is trading around 1.1317, down 0.01% for the day. In the previous day’s session, the major pair fell to new lows since July 2020 but rebounded to end on a slight gain from 1.1263. While the US dollar continues to be pressured by falling Treasury bond yields, buyers are confronted with a simple calendar in a sluggish session.

With yields on the 10-year US Treasury down two basis points (bp) for the day, the US Dollar Index (DXY) drops for the second consecutive day, down 0.09% by 95.70. In other news, the DXY hit a new 16-month high, while US bond yields hit a three-week high the previous day but finished negative for the first time in a week.

As important catalysts for reluctance, a soft start in the US housing market and a two-day decline in inflation expectations can be identified. In addition, Reuters reported that the 10-year break-even rate for US inflation expectations from the St. Louis Federal Reserve System (FRED) declined for the second day in a row on Wednesday.

Furthermore, ECB policymakers refusing to raise interest rates out of concerns about reflation and expectations of moderate economic growth in the future also favored buyers of EUR/USD the day before. According to Charles L. Evans, head of the Federal Reserve Bank of Chicago, “The Fed will not complete its bond-buying program until the middle of next year, even if it remains in place warning of inflation.”

Recent US supply chain improvements and Evergrande’s offer to sell 1 billion shares of Hengten Networks for HK$1.28 could cause cautious optimism in the market.

The Philadelphia Fed’s November Manufacturing Review, which is expected to increase from 23.80 earlier, will include US jobless claims, projected to decline from 267,000 to 260,000. As the discrepancy between the next steps of the ECB and the Fed has widened in recent weeks, policymakers at the two central banks are paying close attention to their comments.

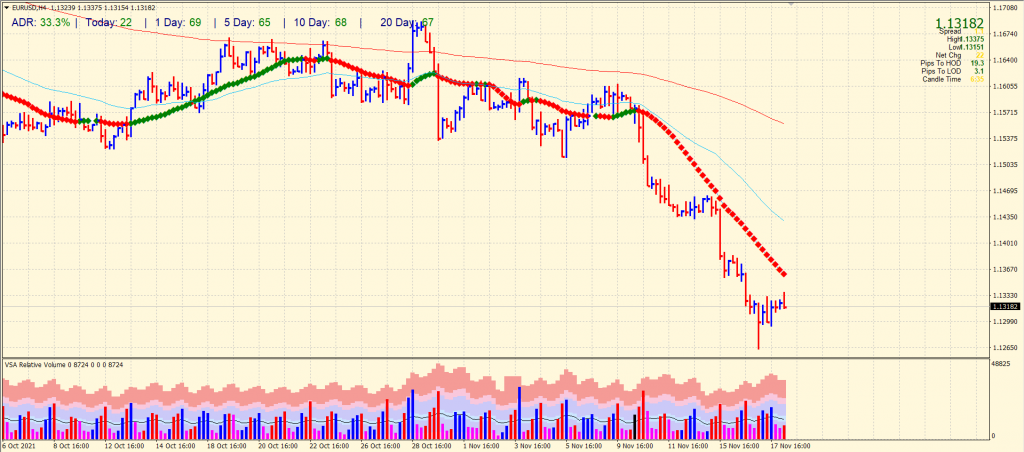

EUR/USD price technical forecast: 20-SMA to cap rallies

The EUR/USD price is consolidating just above the 1.1300 area, failing to break the upside. The pair is still below the 20-period SMA on the 4-hour chart, which might act as stiff resistance for now. The outlook is still negative for the Euro while the volume is drying up, which indicates a potential breakout to appear soon.

–Are you interested to learn about forex bonuses? Check our detailed guide-

On the downside, the multi-month bottom around 1.1260 might provide support ahead of 1.1200. The average daily range is 33% so far, which indicates normal volatility for the day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.