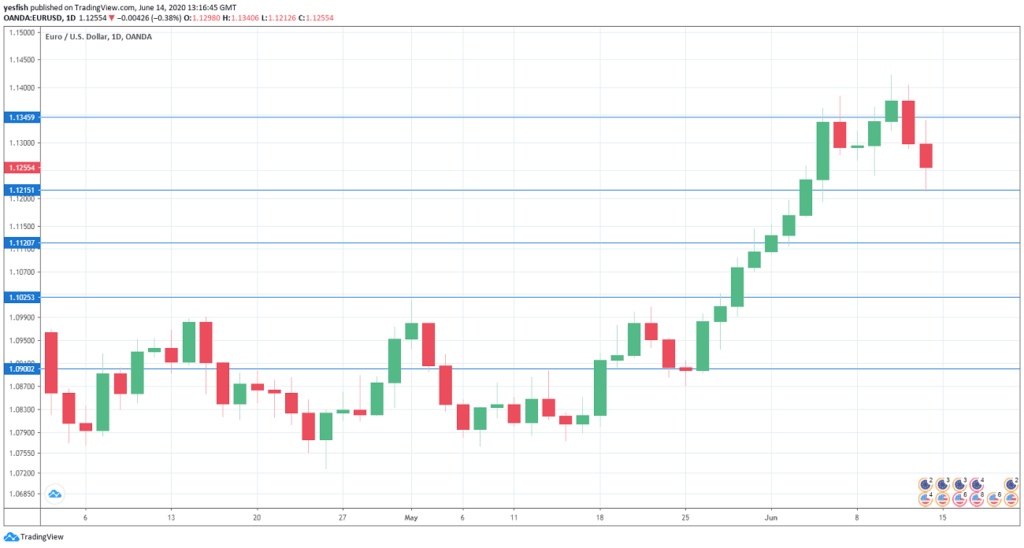

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Eurozone Trade Balance: Monday, 9:00. The trade surplus narrowed in May to EUR 23.5 billion, down from EUR 25.8 billion a month earlier. The surplus is expected to narrow to EUR 20.3 billion.

- German Inflation: Tuesday, 6:00. Inflation in the eurozone’s largest economy declined by 0.1%, indicative of weak economic conditions. The final read is expected to confirm this figure.

- German ZEW Economic Sentiment: Tuesday, 9:00. Investor confidence jumped unexpectedly in May to 50.0, crushing the forecast of 30.0 points. The upswing is expected to continue in June, with an estimate of 60.0 points. The all-euro indicator is projected to climb to 54.3, up from 46.0 points.

- Eurozone Inflation: Wednesday, 9:00. Eurozone inflation slipped to 0.1% in May’s initial reading, down from 0.3% a month earlier. This figure is projected to be confirmed in the final reading. The core figure was unchanged at 0.9% in the initial reading for May and the final read will likely confirm this reading.

- German PPI: Friday, 6:00. Producer Prices feed into consumer ones. The locomotive of the euro has seen a decline in PPI for three straight months, with a decline of 0.7% in April. A smaller decline is expected in May, with a forecast of -0.3 percent.

- Eurozone Current Account: Friday, 8:00. Similar to the narrower trade balance, the current account is in positive territory thanks to German exports. The surplus fell to EUR 27.4 billion in March, down from EUR 40.2 billion beforehand. We now await the April data.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1620 has held in resistance since early October 2019.

1.1515 was a high point at the end of January. 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1215 is providing support. 1.1119 is next.

1.1025 (mentioned last week) switched to support in late May.

1.0920 is the final support level for now.

.

I am bearish on EUR/USD

Despite severe economic conditions in the eurozone, the euro has posted gains of 2.5% since the end of April. However, this is more a result of dollar weakness than an attractive euro. If the U.S. economy shows signs of recovery, I expect the euro to lose ground.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week Safe Trading!