- EUR/USD has been advancing amid optimism in trade talks.

- US retail sales and concerns about the euro-zone fiscal stimulus may weigh on markets.

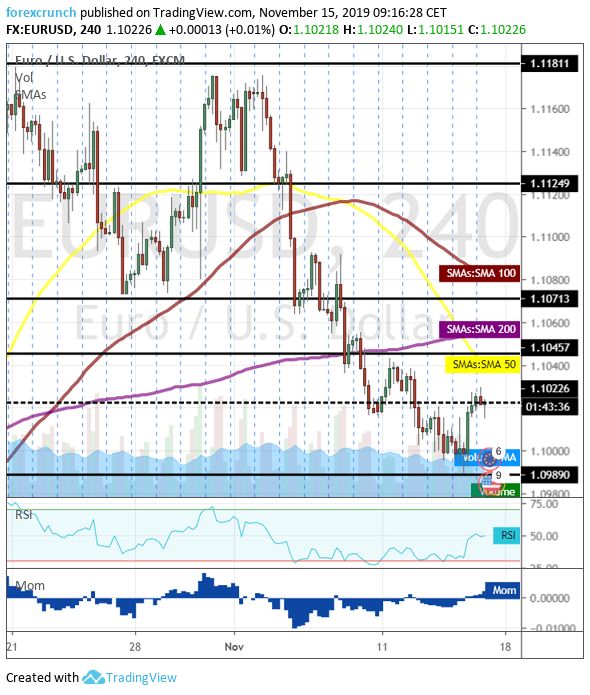

- Friday’s four-hour chart is pointing to further falls.

Are the US and China on the verge of signing a trade deal? Optimism is sweeping markets, weighing on the safe-haven US Dollar, and allowing EUR/USD to hold onto 1.10 that it lost on Thursday. However, these hopes may be unjustified.

Larry Kudlow, Director of the National Economic Council for President Donald Trump, has said that a deal is “down to the short stokes” – a term from golf that the president likes to play. However, it is essential to note that Kudlow has always been the optimist. Only last week, he hinted that the world’s largest economies are set to remove tariffs – only to be denied by Peter Navarro, the White House’s China hawk. Moreover, Trump has also referred to reports about abandoning duties as incorrect.

Without confirmation from Trump, optimism may erode – the same happened in early November when a Chinese announcement of an upcoming deal was met with silence. A denial would already send stocks lower – carrying euro/dollar with it.

Mixed blessing for Germany, US retail sales

The euro side of the equation may also drag the world’s most popular currency pair down. Germany has narrowly averted a recession by growing in the third quarter, defying expectations for a second consecutive quarter of contraction. However, the “locomotive” of the old continent grew at a meager pace of 0.1% quarterly – and escaping a downturn may be a double-edged sword. Without headlines screaming of a slump, policymakers in Berlin may feel at ease with current policies – and refrain from stimulating the economy. Chancellor Angela Merkel and her grand coalition have been reluctant to spend – thus extending the snail’s pace expansion of the whole continent.

Europ’s sluggish growth, at 0.2% quarterly, contrasts America’s 0.5% quarterly increase in output. Jerome Powell, Chairman of the Federal Reserve, has stated that the US is a “star economy” – and reaffirmed his positive stance. Powell and four of his colleagues at the Fed conveyed a clear message on Thursday – they are content with the current level of interest rates and are set to leave policy unchanged for the time being. The Washington-based institution’s optimism outshines its peers.

Affirmation of US economic strength is due later today, with the release of the Retail Sales report for October. Around 70% of America’s economic activity is centered around consumption. After somewhat disappointing figures in September, a substantial pickup is on the cards -,, especially in the all-important Control Group.

See US October Retail Sales Preview: Consumers keep faith with the economy

Overall, trade headlines, stimulus speculation, and US data are set to determine euro/dollar’s path today.

EUR/USD Technical Analysis

EUR/USD has risen above 1.10, but also pulled the Relative Strength Index on the four-hour above 30. The RSI does not indicate oversold conditions and allows for further falls.

EUR/USD remains below the 50, 100, and 200 Simple Moving Averages, but the euro finally enjoys upside momentum.

Resistance awaits at 1.1045, which capped euro/dollar earlier this week. It is followed by 1.1070, which provided support twice in late October. It is followed by 1.1125, which served as support when the pair traded at the high ground two weeks ago. 1.1180 is next.

Looking down, Support awaits at 1.0990, the low point on Thursday. It is followed by 1.0940 and 1.0905, which were both swing lows on the way down. The 2019-trough of 1.0879 is next.