- EUR/USD has been consolidating the gains fueled by the weak US Non-Farm Payrolls.

- The ECB has reportedly been worried about the exchange rate and de-anchoring of inflation expectations.

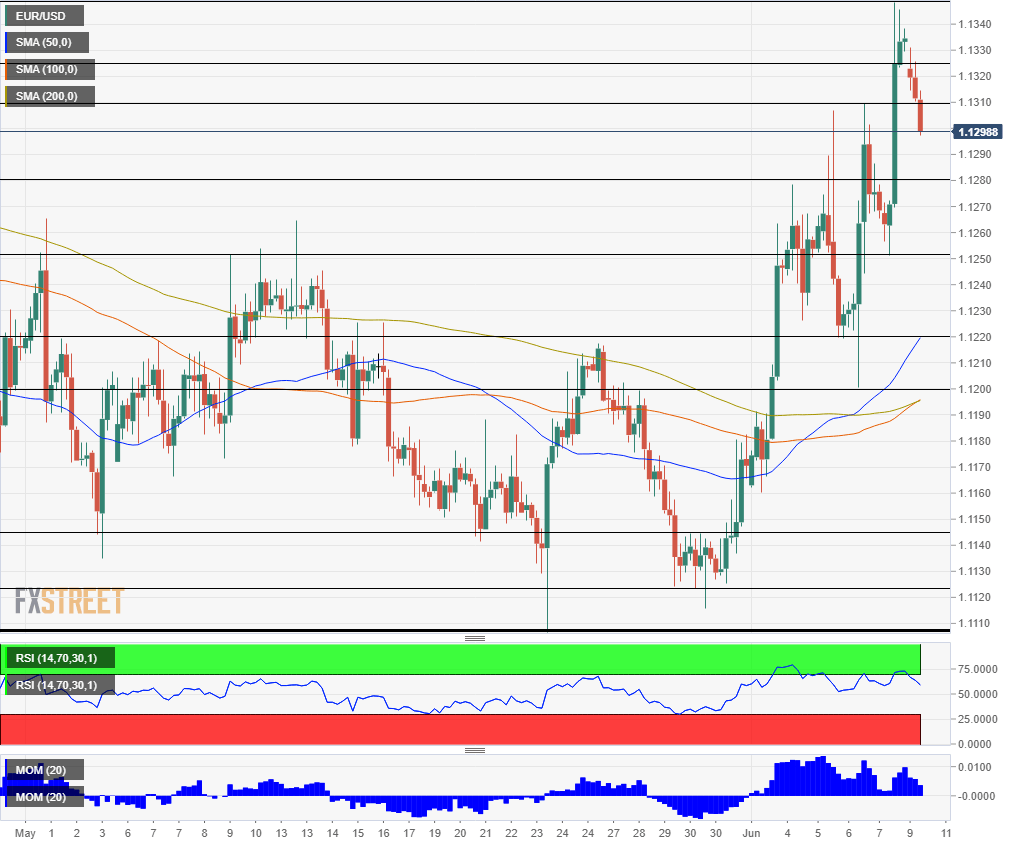

- Monday’s technical four-hour chart points to further gains for the pair.

EUR/USD seems to have sobered up – gaining on the weakness of the USD is short-lived – as the monetary union has issues of its own. Reuters has reported that officials at the European Central Bank are considering cutting interest rates if growth further weakens. They are also reportedly concerned about inflation expectations being de-anchored – that markets do not believe the ECB’s ability to reach their 2% inflation target. Moreover, a source said that the central bank is unhappy with the euro’s exchange rate.

These reports have weighed on EUR/USD, triggering its consolidation and overshadowing positive developments. The US will refrain from imposing tariffs on Mexico both countries secured a deal to curb inflows of central-American migrants to the US. Markets have cheered the news.

On Friday, euro/dollar surged after the US reported an increase of only 75K jobs and a deceleration in wage growth to 3.1%. Thee disappointing Non-Farm Payrolls report has fueled speculation of a rate cut by the Federal Reserve. The central bank meets next week and is projected to keep rates unchanged. However, bond markets are pricing in a reduction in rates in July.

Germany, France, and several other European countries are on holiday today – implying lower liquidity and few events on the economic calendar. In the US, only the JOLTs job openings report is due later in the day.

Overall, markets will likely be assessing the odds for a US rate cut and further ECB stimulus.

EUR/USD Technical Analysis

EUR/USD has exited overbought conditions it had suffered from late on Friday – the Relative Strength Index on the four-hour chart has dropped below 70. Momentum remains positive but is winding down.

Resistance awaits at 1.1310 which was the high point on Thursday. 1.1325 was a stubborn cap in April, and Friday’s 11-week high of 1.1348 is next. The next level is 1.1395 and dates back to March.

Looking down, 1.1280 was a swing high in early June and now turns to support. 1.1250 was a stepping stone on the way up last week, and 1.1220 separated range in May. The round number of 1.1200 was a swing low last week.