- Investors await the European Central Bank’s decision at 1215 GMT.

- The US Federal Reserve implemented a quarter-point rate hike on Wednesday.

- The European Central Bank will likely raise rates by a quarter-point.

Today’s EUR/USD outlook is bullish. On Thursday, the euro rose as the focus shifted from the widely-anticipated US interest rate hike to a similar move expected from the ECB later.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Investors now await the European Central Bank’s decision at 1215 GMT. Moreover, they expect a quarter-point hike as it nears the conclusion of its tightening campaign. The US Federal Reserve implemented a quarter-point rate hike as expected. Furthermore, Chair Jerome Powell stated that a recession is no longer anticipated.

David Chao, a strategist at Invesco, expressed the belief that the Fed’s tightening cycle has peaked. This is despite the Fed leaving the door open for one more rate hike before the year’s end. However, market futures suggest only a slim possibility (about 20%) of a surprise quarter-point increase in September. In contrast, markets are pricing significant rate cuts of 125 basis points by the end of next year.

The European Central Bank will likely raise rates by a quarter-point during its rate decision. However, the market senses that the end of rate hikes is approaching, with at most one more increase after this week.

Nonetheless, the slow retreat of inflation could pressure policymakers to continue the rate hikes or maintain higher rates for an extended period. Jefferies economist Mohit Kumar expects a 25 basis point hike but highlights the importance of guidance for future policy meetings.

EUR/USD key events today

Although there will be economic releases from the US, all focus will be on the ECB policy meeting. Investors will also focus on the press conference after the meeting for clues on future policy moves.

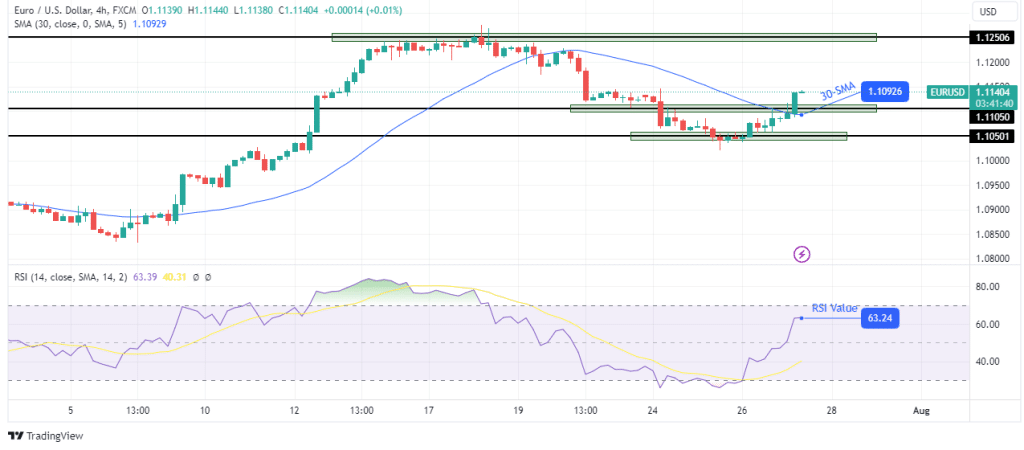

EUR/USD technical outlook: Price breaks above 30-SMA and 1.1105 resistance.

On the charts, the EUR/USD has crossed above the 30-SMA and the 1.1105 resistance level. This shows that bulls have taken control. Consequently, the bias has shifted from bearish to bullish. Moreover, the RSI has crossed above 50, indicating a surge in bullish momentum.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

We might see the price retest the 1.1105 key level from here before climbing toward the next resistance at 1.1250. Such a move would confirm a new bullish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money