- Retail sales in the Eurozone remained stable in May.

- Most Fed officials anticipated the eventual need for tightening monetary policy.

- Traders in futures linked to the Fed policy rate anticipate a rate hike in July.

Today’s EUR/USD outlook is slightly bullish. The euro rose after data revealed that retail sales in the Eurozone remained stable in May. Increased expenditure on non-food items balanced out the declines observed in food and automotive fuel sales.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Retail sales volumes in the 20 euro-sharing nations remained unchanged compared to April. However, they showed a 2.9% decrease compared to last year’s period.

The sluggish consumption is due to declining real incomes. Notably, households allocate much of their earnings towards costly energy, credit, and mortgage repayments. This has led to a reduction in demand for other goods.

Meanwhile, the June meeting minutes revealed that the US Federal Reserve, acting in unison, decided to maintain the current interest rates. While most participants anticipated the eventual need for tightening monetary policy, they agreed to uphold the current rates.

Following the release of the minutes, the market experienced minimal changes. Moreover, traders in futures linked to the Fed policy rate continued to anticipate a rate hike in July. They estimated a one-in-three probability of another increase by the year’s end.

Simultaneously, policymakers grappled with data indicating a persistently tight job market and modest improvements in inflation. Niels Christensen, the chief analyst at Nordea, commented that there were no significant surprises. Markets already expect the Fed’s July rate hike, which is positive for the dollar.

EUR/USD key events today

Investors expect a slew of key economic reports from the US that will shed light on the labor market and services sector. These reports include the ADP nonfarm employment change, initial jobless claims, JOLTs job openings, and services PMI.

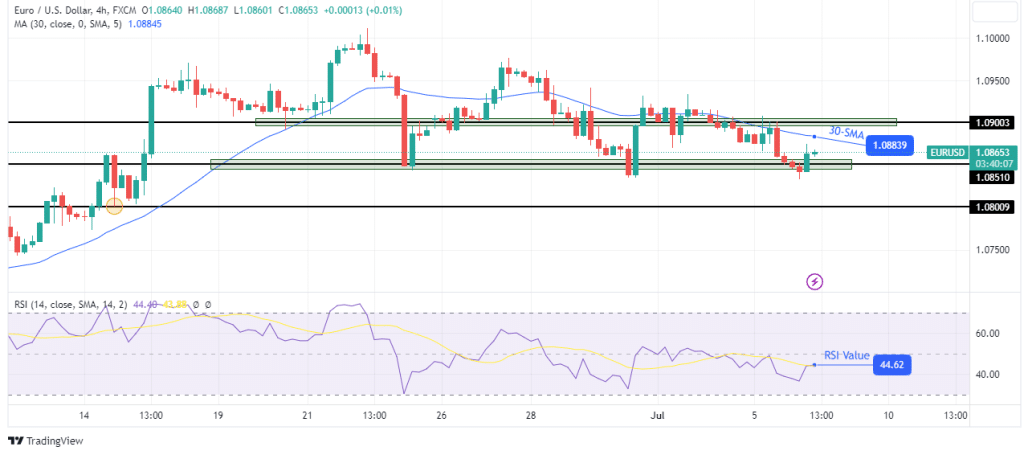

EUR/USD technical outlook: Price retests the strong 1.0851 support.

The bias for the EUR/USD on the charts is bearish. The price trades below the 30-SMA, showing bears are in control. Additionally, bearish momentum is strong as the RSI trades below 50.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

However, the downward move has paused at the 1.0851 support level. This has happened twice before, and the price bounced higher each time. Therefore, bulls might push the price above the 30-SMA and the 1.0900 resistance level. However, if bears are stronger this time, they might break below 1.0851 and retest the 1.0800 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money