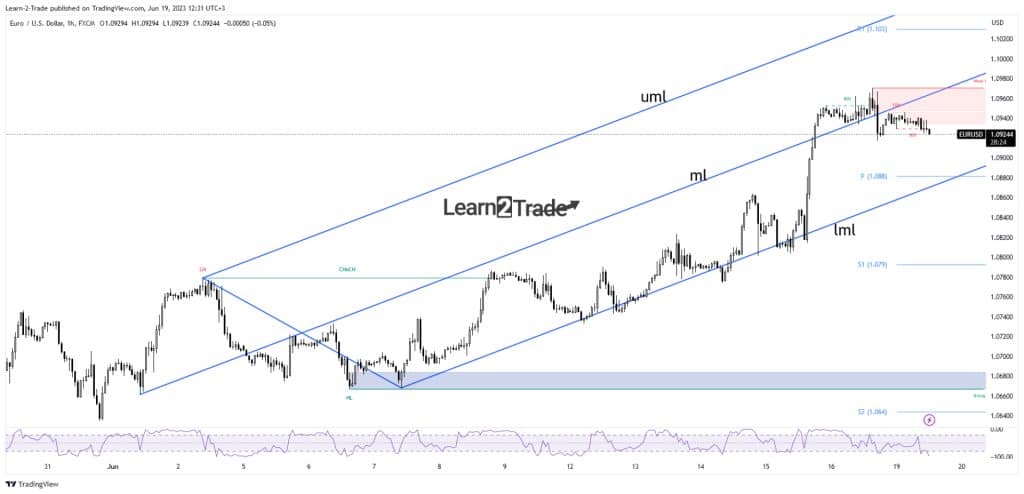

- Failing to stay above the median line (ml) announced a sell-off.

- The lower median line (lml) represents a downside target.

- The fundamentals should bring more action during the week.

The EUR/USD price climbed as high as 1.0960 on Friday, registering a new higher high. Today, the pair has turned to the downside and is located at 1.0911 at the time of writing.

-If you are interested in forex day trading then have a read of our guide to getting started-

After its strong upwards movement, a downside correction was highly probable. Fundamentally, the Eurozone Final CPI and Final Core CPI came in line with expectations.

On the other hand, the greenback received a helping hand from the US Prelim UoM Consumer Sentiment. The economic indicator came in at 63.9 points versus 60.1 points expected, compared to 59.2 points in the previous reporting period.

Today, the US banks will be closed in observance of Juneteenth. Tomorrow, the Eurozone will release the German PPI and Current Account, while the US will release Building Permits and Housing Starts data.

Furthermore, the Fed Chair Powell Testifies, UK CPI, SNB, and BOE could shake the price on Wednesday and Thursday.

The Fundamentals should move the rate on Friday, and the US and Eurozone are to release the Flash Manufacturing PMI and Flash Services PMI data.

EUR/USD price technical analysis: Corrective phase

Technically, the currency pair jumped above the ascending pitchfork’s median line (ml). However, the price has failed to stay above it, signaling exhausted buyers.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Dropping below it and trying to retest this dynamic resistance may trigger a potential correction in the short term. Closing below Friday’s low of 1.0917 may announce more declines toward the weekly pivot point of 1.0880.

The lower median line (lml) of the ascending pitchfork also represents a potential downside target and obstacle. From the technical point of view, its failure to approach and reach the weekly R1 of 1.1030 signaled a potential sell-off. Still, a temporary retreat could bring us new long opportunities. Only taking out the lower median line (lml) activates a larger drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.