- EUR/USD has been extending its gains amid optimism about trade talks.

- Comments on negotiations from President Trump are awaited.

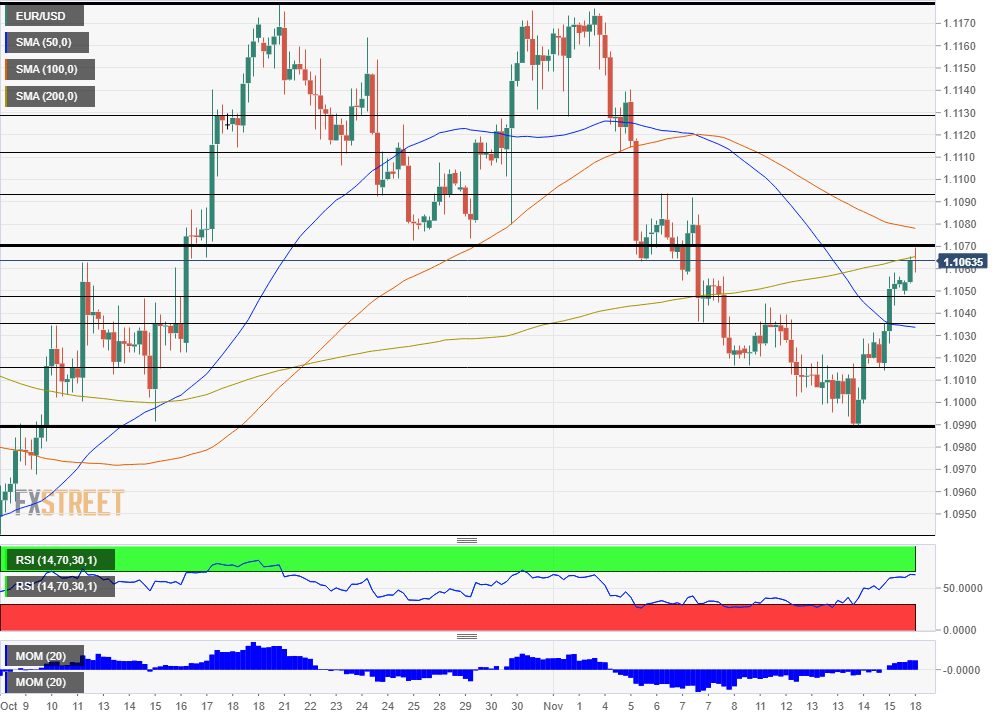

- Monday’s four-hour chart is showing that critical resistance is close.

Brick by brick, EUR/USD is rising in response to reports that trade talks have been constructive. The upbeat mood in markets is supporting the euro and weighing on the safe-haven dollar.

US Trade Representative Robert Lighthizer and Treasury Secretary Steve Mnuchin spoke with Chinese Vice Premier Liu He over the weekend and used video conferencing – yet additional details are lacking. Nevertheless, the positive labeling of the negotiations joins optimistic words from US Commerce Secretary Wilbur Ross, who expressed optimism on Friday.

As always, the final word belongs to President Donald Trump, who is yet to decide on the removal of tariffs that markets so keenly desire to see. The administration’s plans to slap new duties on China on December 15 are still intact with four weeks to go.

Comments by Trump – potentially via twitter – may rock markets later today. See US-China trade and the global economy: Q&A with FXStreet senior analyst Joseph Trevisani

Beyond trade – eyeing central bankers

Mary Daly, President of the San Francisco branch of the Federal Reserve, has said that the low interest-rate environment has been supporting the US economy. Nevertheless, the central banker has maintained the Fed’s line, backing a long pause in rates after three cuts. The bank’s meeting minutes are due out on Wednesday, and they may shed more light on the path of monetary policy.

On the other side of the pond, several members of the European Central Bank will be speaking during the day. Luis de Guindos, the bank’s Vice-President, and Phillip Lane, the Chief Economist, stand out. They will likely repeat the ECB’s call on governments to do more.

Last week, Germany reported a meager growth rate of 0.1% in the third quarter – enough to save it from a recession. Some fear that escaping an official downturn may limit any fiscal response to the substantial slowdown.

With a few indications on the economic calendar, the focus remains on trade talks and central bank speculation.

EUR/USD Technical Analysis

Momentum on the four-hour chart has turned positive and euro/dollar has broken above the 200 Simple Moving Average after topping the 50 SMA late last week. Overall, bulls have gained considerable ground.

The critical test is at 1.1070, which is the fresh high and it also provided support twice in October. Further up, 1.1090 capped EUR/USD twice in November, and 1.1110 was a swing low early this month and also a considerable confluence line. Next, we find 1.1130 and 1.1180.

Support awaits at 1.1045, today’s low point, followed by 1.1035, a swing low from early in the month. Next, we find 1.1015, and 1.0990 – November’s low point.

More: EUR/USD Forecast: Recovery could continue in the short-term