- EUR/USD has been struggling amid concerns about the covid strain and a slow pace of vaccinations.

- The focus is on Georgia’s special elections which are critical to further US stimulus.

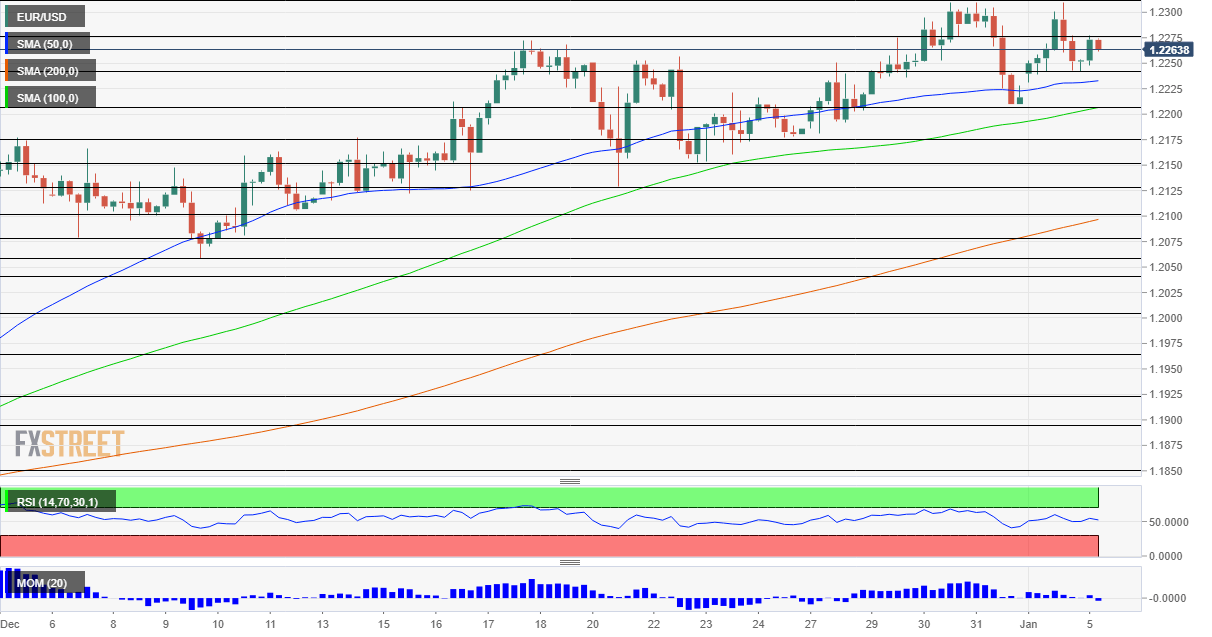

- Tuesday’s four-hour chart is painting a mixed picture for the pair.

Is the bout of bad covid news priced into EUR/USD? That is the key question after markets suffered on the first trading day of 2021. If markets already price in the depressing developments, there is room to rise and re-attack 1.2310.

The UK announced a third – and harsh – nationwide lockdown to slow the spread of coronavirus and its highly contagious variant. Germany extended its restrictions and other countries may follow as the winter wave continues raging. The US is also struggling with record hospitalizations, and data on both sides of the pond is probably incomplete amid the holidays.

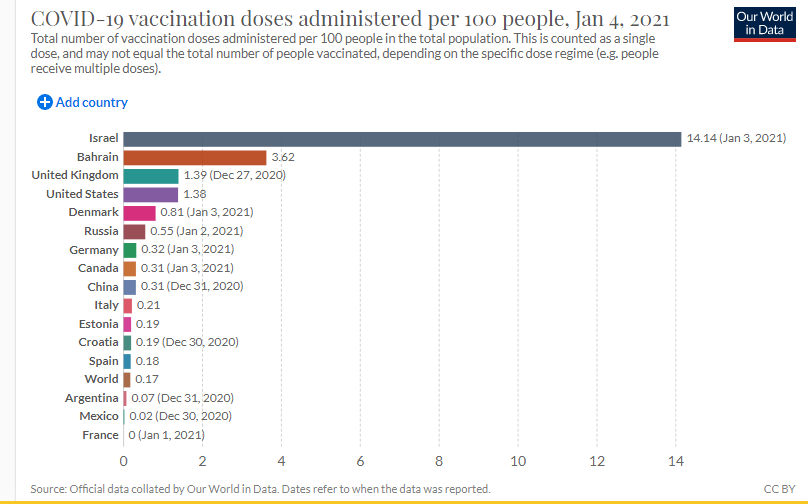

Another source of concern comes from the vaccination campaign, which is advancing at a snail’s pace. Germany is leading the eurozone, but with only around 0.32% of its population having received the inoculation. France’s distribution is in the hundreds. While the US is doing better, bottlenecks and disarray have resulted in only 1.38% of the population receiving either the Pfizer/BioNTech or Moderna jabs.

Source: OurWorldInData

Uncertainty about Georgia’s special elections also troubled investors on Monday – but there is room for optimism, at least during Tuesday. Markets prefer both Democratic candidates Jon Ossof and Raphael Warnock to win their respective races against Republican senators David Perdue and Kelly Loeffler. A dual victory would provide President-elect Joe Biden room to push for more stimulus.

Recent opinion polls – which have been relatively accurate in the general elections – show a small lead for Dems. High Black turnout in early voting also contributed to hopes. Will Election Day turnout remain high? The national attention on the runoffs suggests voters will rush to the polls also on Tuesday, thus raising hopes for a Democratic win.

Reports of long lines in Atlanta could boost stocks and weigh on the safe-haven dollar – potentially sending EUR/USD above 1.23 before voting ends.

See Georgia Elections Preview: Markets geared for a special moment, three scenarios

Outgoing President Donald Trump continues his campaign to overturn the election results and that also worried investors. However, his attempts will likely end when Congress certifies Biden’s win in a special session on Wednesday.

The US ISM Manufacturing Purchasing Managers’ Index is set to remain at an elevated level, showing strength in the industrial sector. The employment component is eyed as the first hint toward Friday’s Nonfarm Payrolls.

See Manufacturing PMI Preview: COVID is the present but recovery is the future

Overall, after a down day, the mood may improve and push EUR/USD higher.

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100 and 200 Simple Moving Averages on the four-hour chart but momentum turned marginally to the downside.

Some resistance was at the daily high of 1.2280. It is followed by the critical double top of 1.2310. Above that level, the stretch target for the pair is 1.24.

Support is at 1.2240, the daily low, followed by 1.2210, a swing low in the late hours of 2020. Further down, 1.2175 awaits EUR/USD.

More EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750