- EUR/USD has been holding its ground amid upbeat trade headlines.

- A big bulk of US data is set to rock markets ahead of Thanksgiving.

- Wednesday’s technical chart is pointing to falls for euro/dollar.

President Donald Trump has suggested that US-Sino talks are in their “final throes” – a term that is often used for describing violent, uncontrolled movements that a person makes just before dying. However, markets are far from behaving violently, with EUR/USD steady above 1.10.

The president has probably meant that most of the deal is done, echoing the sentiment from officials on both sides of the Pacific. He added that sealing the deal depends on him. Optimism has been moderately weighing on the safe-haven dollar.

Lael Brainard, Governor at the Federal Reserve, has reaffirmed the bank’s stance about leaving monetary policy unchanged. The Fed remains data-dependent, and it will undoubtedly receive top-tier data today.

Massive US data dump

A substantial amount of economic figures is coming out today, some of it usually published on Thursdays, but authorities have brought forward several publications due to the Thanksgiving holiday. The upcoming absence of US traders may trigger choppy movements.

There are three substantial numbers to watch. First, Gross Domestic Product for the third quarter will likely be confirmed at 1.9% annualized, better than other developed economies. Changes in the composition of growth are of interest. Consumption has to lead the economy while investment has been dragging it lower.

See US GDP Preview: Stronger than predicted US growth

The Conference Board’s Consumer Confidence measure for November edged lower but remains at high levels. Today’s second significant publication is related to investment – Durable Goods Orders. Excluding defense and aircraft, economists expect orders to have dropped in October, extending the slump in long-term outlays.

See Durable Goods Orders Preview: The revival in business investment is not yet in sight

Last but not least, the Fed’s preferred measure of inflation, the Core Personal Consumption Expenditure (Core PCE) is set to show that underlying inflation remained below the bank’s 2% target in October.

In the old continent, the European Parliament is set to confirm the new European Commission led by Ursula von der Leyen. The former German defense minister has struggled to confirm some of her nominees. Von der Leyen will first have to steer the bloc’s seven-year budget before trying to tackle climate change and other topics.

All in all, EUR/USD is data-dependent.

EUR/USD Technical Analysis

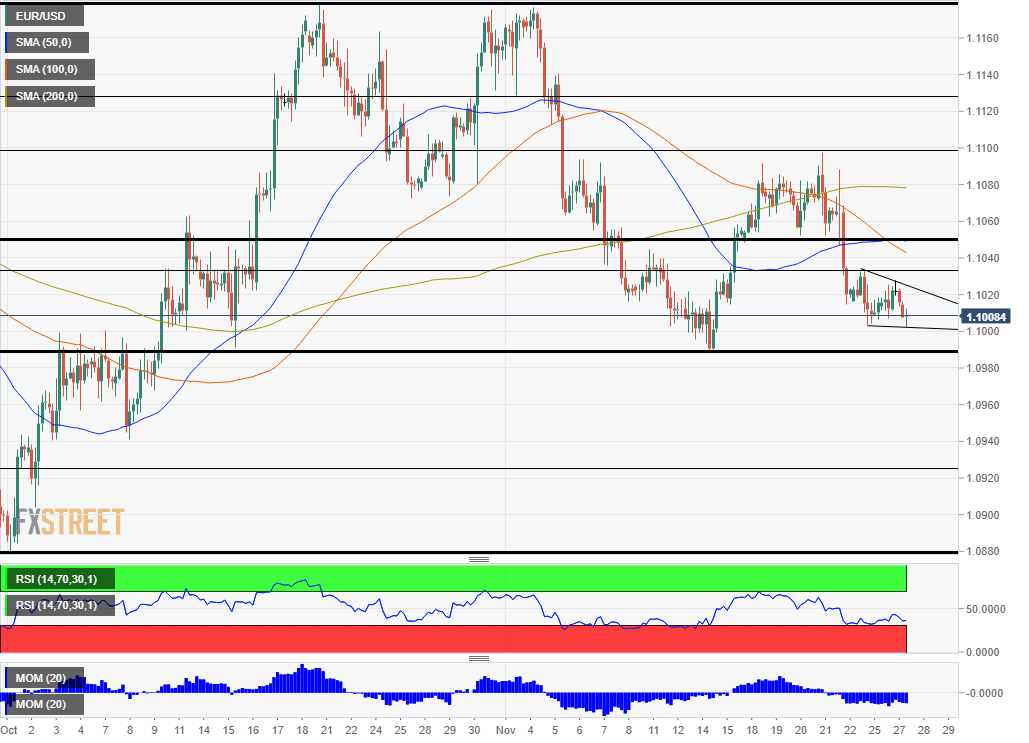

While volatility has been limited, euro/dollar set lower highs and lower lows, a bearish sign. Moreover, the currency pair is trading below the 50, 100, and 200 Simple Moving Averages on the four-hour chart and momentum is to the downside.

Bears remain in control.

Support awaits at 1.10, a round number, and then by 1.0990, which is the low point in November. Further down, 1.0925 was a double bottom in September and 1.0879 is the 2019 low.

Looking up, some resistance awaits at 1.1035, the weekly high. It is closely followed by the double-bottom of 1.1050, and then by 1.11, another round number and last week’s high. Next, we find 1.1130 and 1.1180.