- EUR/USD has been rising after Fed Chair Powell opened the door to rate cuts.

- The second part of Powell’s testimony, US inflation, and the ECB minutes are set to move prices today.

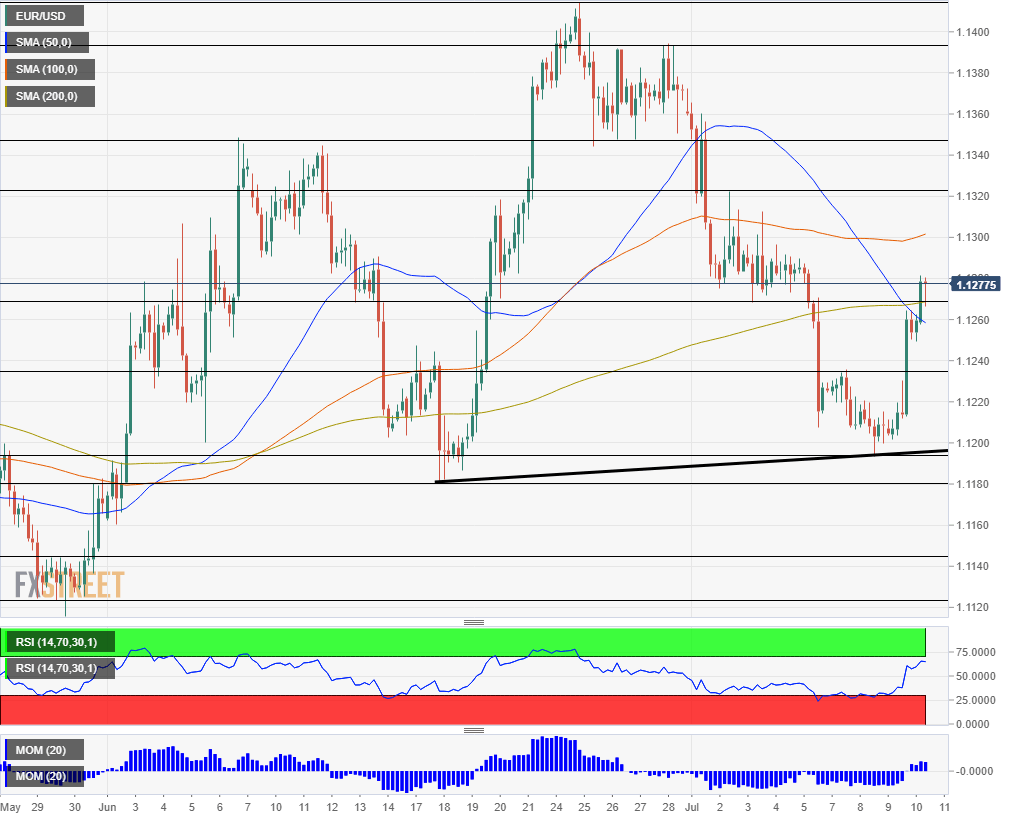

- Thursday’s four-hour chart is showing favorable conditions for EUR/USD bulls.

“The outlook has dimmed” – said Jerome Powell, Chair of the Federal Reserve on Wednesday – and his dovish words continue reverberating and weighing heavily on the US dollar. EUR/USD has advanced to 1.1280.

It has been impossible to sugarcoat Powell’s concerns that weak inflation may become persistent, a notable drop in investment, and his refusal to describe the job market as “hot.” Investors have been fully convinced that the world’s most powerful central bank is set to slash interest rates later this month – for the first time since 2008.

Later on, the Fed’s meeting minutes from the June meeting have echoed the same message – by showing that several members are in favor of reducing interest rates. Powell will testify again today – this time before a Senate committee – and will likely repeat the same messages. His answers to politicians’ questions may reveal more of the Fed’s thinking.

Powell has mentioned subdued inflation and today’s Consumer Price Index (CPI) report for June will provide a fresh update. Annual core CPI – which is the most significant figure – is forecast to remain at 2%. However, Powell’s concerns about inflation may have lowered real expectations. The central bank often receives an advance copy of the data.

See US CPI Preview: Inflation is secondary

Today is the European Central Bank’s turn to publish its meeting minutes from the rate decision in June. Back then, President Mario Draghi expressed concerns but his most dovish words came only afterward – in the ECB’s conference in Sintra, Portugal.

The document may reveal more willingness to slash rates and perhaps resume the bond-buying program. If the minutes are gloomy, EUR/USD may reverse some of its gains.

Overall, central banks are set to dominate price action once again.

EUR/USD Technical Analysis

The technical picture for EUR/USD has significantly improved. The world’s most popular currency has set a higher low at 1.1195 and has crossed above the 50 and 200 Simple Moving Averages on the four-hour chart. Moreover, momentum has turned positive and the Relative Strength Index is on the rise.

The 100 SMA at the round number of 1.1300 may serve as resistance but the more significant caps are higher. 1.1320 capped EUR/USD in early July, while 1.1350 served as support in late June. The next lines to watch are 1.1390 and .11410.

Some support awaits at 1.1270 which held up EUR/USD last week. It is followed by 1.1135 which held it down earlier this week and by the weekly low of 1.1195.