- EUR/USD has been extending its decline as upbeat US data and stimulus hopes boost Treasury yields.

- Further developments in Washington, US jobless claims and vaccine developments are eyed.

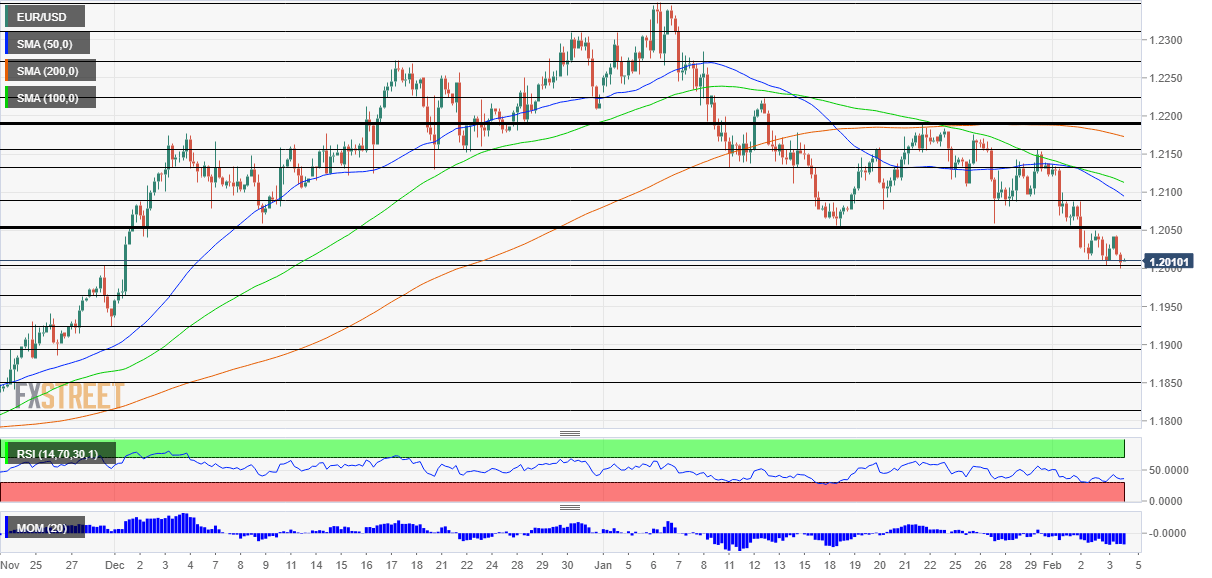

- Thursday’s four-hour chart is pointing to further losses.

It seems like a matter of when, rather than a matter of if – EUR/USD is on the verge of breaking below 1.20, thus sending it to the lowest in two months. The main downside driver is the rise in US yields. The dollar is on the rise as returns on US ten-year Treasuries has hit 1.14%, near the highs seen in early January.

Democrats have taken another procedural step to pass President Joe Biden’s ambitious $1.9 trillion coronavirus relief package without support from Republicans. While the White House has been signaling it is willing to compromise with the GOP – as well as with Joe Manchin, a moderate Democratic senator – markets are beginning to price in a larger boost to the economy than beforehand. A plan worth roughly $1.3 trillion seems possible.

Better growth prospects and high debt issuance push funds away from bonds and the resulting higher yields make the greenback more attractive. Moreover, such stimulus would also come on top of a recovering economy, as seen by Wednesday’s upbeat figures.

ADP’s private-sector job statistics pointed to an increase of 174,000 positions in January, while the ISM Services Purchasing Managers’ Index advanced to 58.7 points. Both beat estimates and raise expectations for Friday’s Nonfarm Payrolls. Weekly jobless claims are also forecast to show improvement.

See Initial Jobless Claims Preview: Do rising claims augur job losses in January?

America’s accelerated vaccination campaign also provides hope for a rapid exit from the crisis, while Europe continues lagging behind following several debacles. Euro bulls may find some solace in AstraZeneca’s intention to send doses over the weekend, allowing some places to reignite paused campaigns.

Another glimmer of hope comes from Italy, where former European Central Bank President Mario Draghi was given the chance to form a government amid the country’s political crisis. Draghi is a respected figure that soothed markets over and over, but it is unclear if he can muster a majority.

Overall, the wind continues blowing in favor of the dollar and against the euro.

EUR/USD Technical Analysis

The psychologically significant 1.20 level serves as critical support, and bears may breach it shortly. The Relative Strength Index on the four-hour chart is above 30, thus outside oversold conditions. The currency pair is also trading below the 50, 100 and 200 Simple Moving Averages, also pointing to the downside.

The next line to watch is 1.1960, which provided some support in early December 2020. IT is followed by 1.1930, a swing low around that time, and then by 1.1890 and 1.1850, already dating back to November.

Looking up, the former support line of 1.2050 is strong resistance. Further above, 1.290, 1.2130, 1.2155 and 1.2190 would cap any upside movement.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750