- EUR/USD has been hovering above 1.21 as Brexit headlines seem more gloomy.

- Progress in stimulus talks is eyed after Mnuchin entered talks.

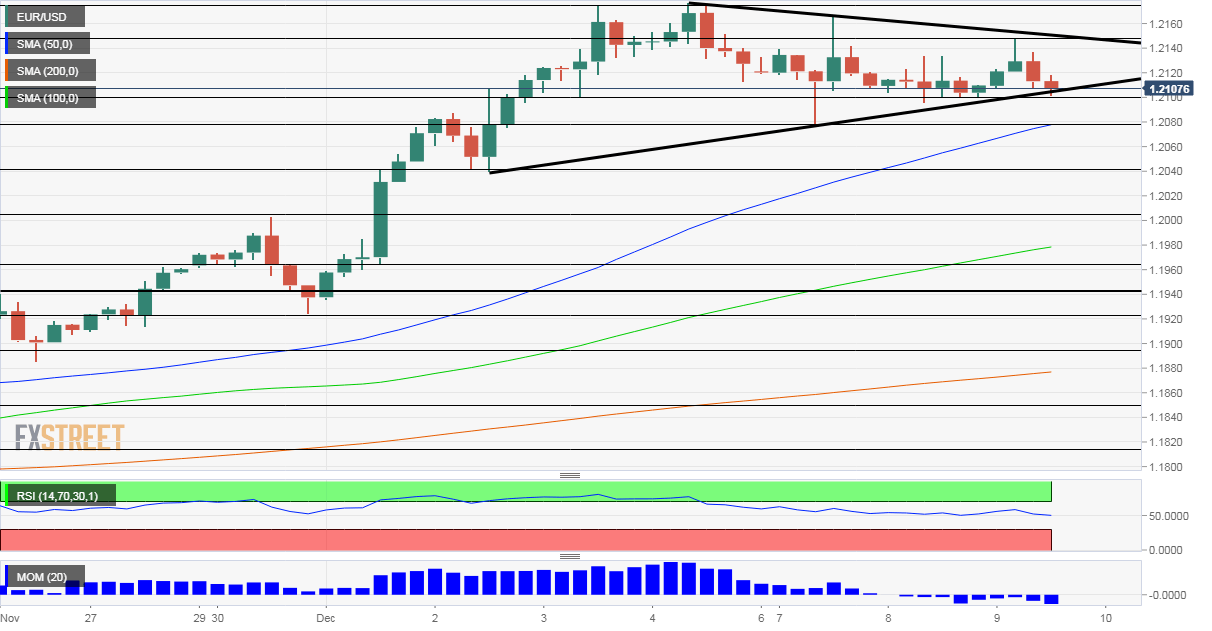

- Wednesday’s four-hour chart is pointing to a narrowing wedge.

Trading in a narrowing wedge has its limits – and when it leaves that triangle, it tends to fly. EUR/USD traders are bracing for volatility, but where will it go to? Two sets of talks hold the key.

Brexit: All eyes are on a dinner table in Brussels at 19:00 GMT – where European Commission President Ursula von der Leyen meets UK Prime Minister Boris Johnson. The leaders meet as negotiations hit the same obstacles again – fisheries, governance, and a level playing field.

Hopes for a British compromise on fisheries and an EU one on an LFP helped lift the pound from its lows, but without clearer reports of a breakthrough, both sterling and the euro are stuck. Further reports from the pre-summit talks will likely cause choppy trading before a full explosion once the meeting concludes. A significant move forward would boost the common currency while a collapse of talks would cause a breakdown.

Stimulus: US Treasury Secretay Steven Munchin said that 90% of the stimulus package details will be completed on Wednesday – a positive sign that joins the high-ranking official’s jump into talks. However, it is always about the remaining 5% or 10%.

Markets will not need to wait for a specific time to hear updates. Both Republicans, who insist on liability waivers, and Democrats, who want funds for states, are likely to talk to the press and move markets. The safe-haven dollar would fall if talks make progress and rise if they hit another wall.

These two sets of talks send coronavirus developments to the background. COVID-19 statistics hit records in the US and remain high in Germany. On the other hand, investors await the US Food and Drugs Administration’s authorization to use the Pfizer/BioNTech vaccine already administered in Britain.

EUR/USD Technical Analysis

Euro/dollar is trading in a narrowing triangle or wedge. Technical textbooks suggest that once the pair chooses a direction, it should trend strongly in that chosen path. Currently, EUR/USD is near the bottom end of the triangle. Break or bounce at support? The answer will come shortly.

Support awaits at 1.21, which is the daily low, followed by 1.2080 and 1.2005.

Resistance is at 1.2150, the daily high, followed by 1.2177 and 1.22.

Three reasons for the massive EUR/USD breakout and big levels to watch