- EUR/USD has been advancing in an extended reaction to the Fed decision.

- European Central Bank officials are also dovish, mitigating the Fed’s effect.

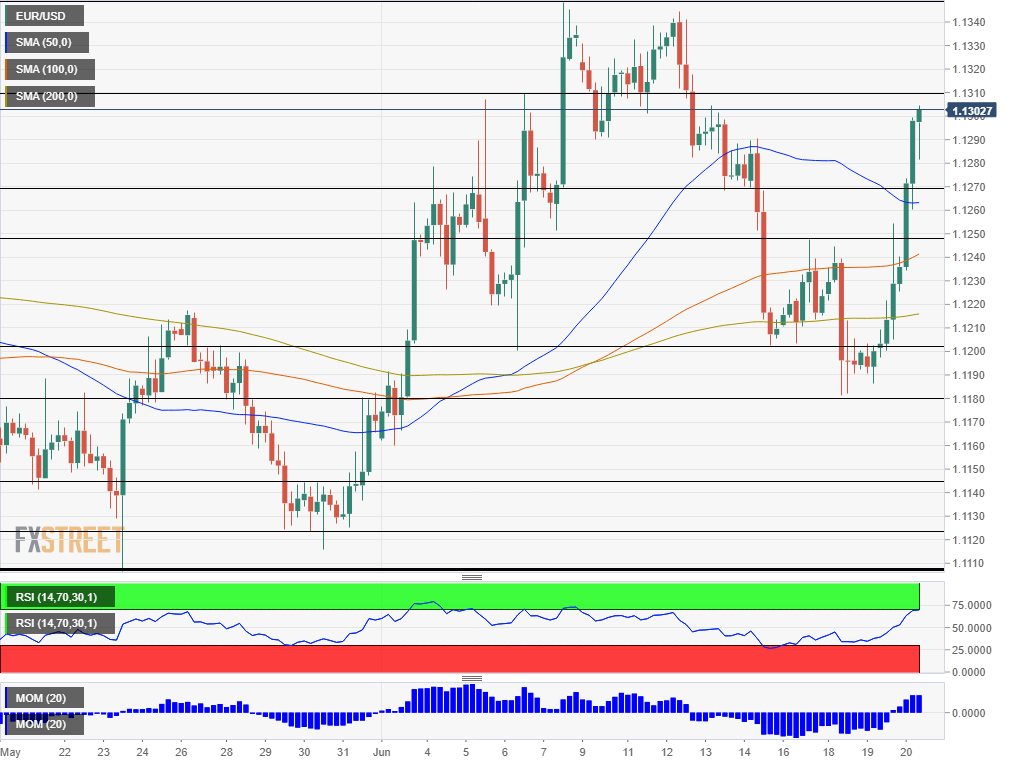

- Thursday’s four-hour chart points to overbought conditions that may lead to a correction.

The Fed has fired up EUR/USD after the European Central Bank sent it down – and the battle continues. The Federal Reserve has met market expectations by dropping the word “patience” regarding interest rates. The Fed is concerned about rising trade tensions and persisting low inflation – and may be ready to cut interest rates.

The Fed’s interest rate projections continue pointing to leaving rates unchanged through the end of the year, but the balance has tilted towards reducing rates. Fed Chair Jerome Powell has expressed satisfaction from the solid labor market and recent retail sales figures – but near term, data may push the Washington-based institution to cut rates – perhaps as early as July.

The US dollar has been on the back foot since the publication with falling yields accompanying the drop. EUR/USD has been rising towards 1.1300 in a gradual yet persistent move. Several commercial banks have also changed their forecasts, foreseeing cuts as deep as 50 basis points in the upcoming meeting.

The ECB is not giving up. Vice President Luis de Guindos and Olli Rehn have both come out supporting rate cuts and perhaps additional QE if the inflation outlook does not improve. They have echoed the words of ECB President Mario Draghi – who sent the euro plunging on Tuesday by setting the stage for more stimulus.

Both central banks have warmed up to more monetary accommodation in a large part due to trade tensions initiated by President Donald Trump. The president – that commented angrily in reaction to Draghi’s speech – also is unhappy with Powell perceived lack of action and would like to fire him.

Both central banks are racing to the bottom due to Trump’s actions on trade and not in response to his tweets – and the battle continues.

Speculation about central banks will likely continue today.

EUR/USD Technical Analysis

The technical picture has dramatically improved for the currency pair. Momentum on the four-hour chart has turned to the upside, and EUR/USD has crossed the 50, 100, and 200 Simple Moving Averages.

On the other hand, the Relative Strength Index is touching the 70 level – entering overbought conditions – and implies a downside correction.

Initial resistance awaits at 1.1310, which was a peak on two occasions in early June. 1.1345 was the high point so far this month. The next lines are 1.1395 and 1.1445, which date back to March.

Support awaits at 1.1270 which had the same role next week, then 1.1250 that capped the currency pair last week, and 1.1200 which provided support early this week.