- EUR/USD maintains a bearish outlook for the week.

- ECB failed to guide the market, now investors await Fed’s statement.

- Technically, the bears can target 1.1700 followed by 1.1500.

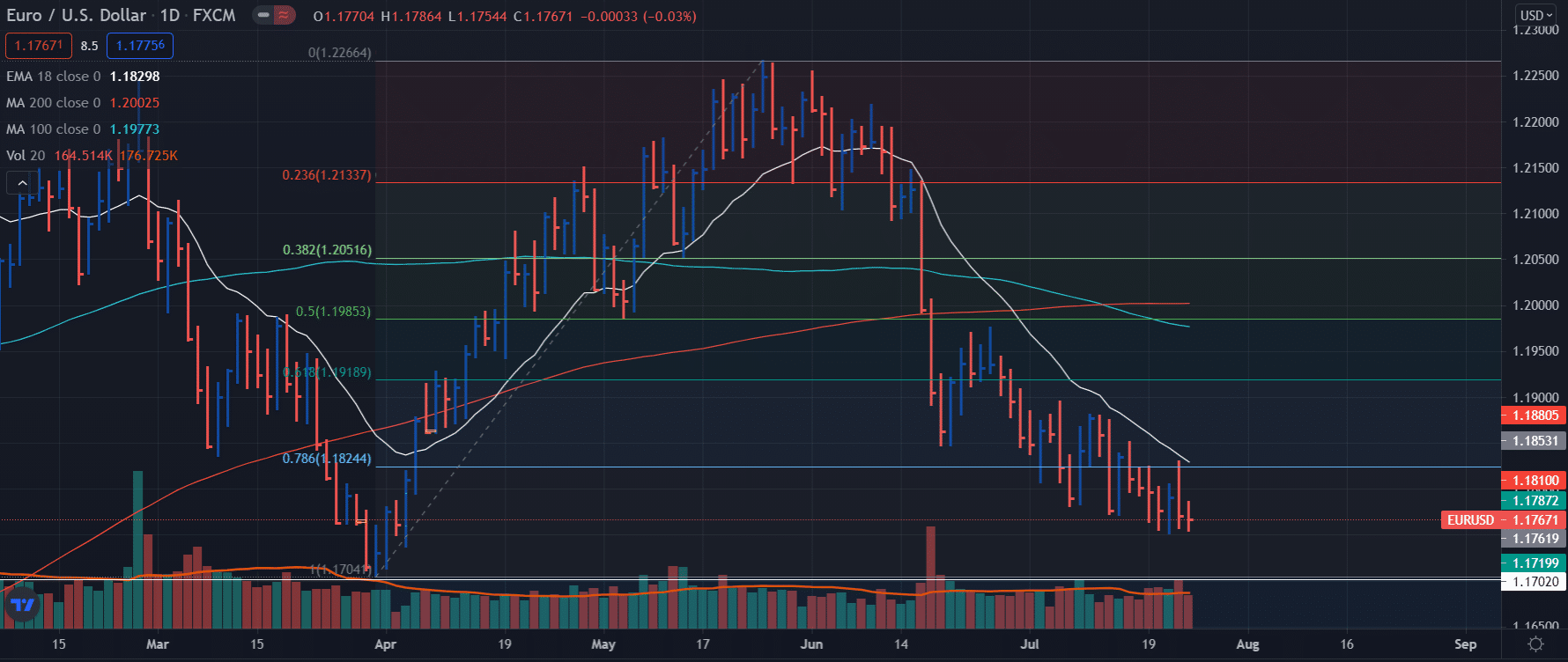

The Weekly forecast for EUR/USD is bearish as at the end of the week, the European currency holds close to local lows in the EUR/USD pair. The pair has been declining for the second week in a row, renewing the 3-month low at 1.1751 and ending the week close to this level. Attempts to rebound above 1.1800 are quickly fading, showing that the bears are in control.

–Are you interested to learn about forex robots? Check our detailed guide-

The dynamics of the Euro were influenced by reports from the research organization Markit Economics. According to preliminary data, in July, the business activity index in the services sector amounted to 60.4 points against the forecast of 59.5 points. On the other hand, the manufacturing sector index decreased from 63.4 to 62.6 points, which turned out to be better than the forecast of 62.5 points.

The composite index of business activity in the Eurozone amounted to 60.6 points. Experts predicted a rise to 60 points. Markit Economics noted that in July, business activity in the region grew the highest this year amid the lifting of restrictions on COVID-19.

Following the results of the last meeting, the ECB was unable to clarify the markets about the further course of its monetary policy. So next week, it will be the Fed’s turn. Perhaps the regulator will hint at curtailing QE by the end of this year.

What to watch next week for EUR/USD?

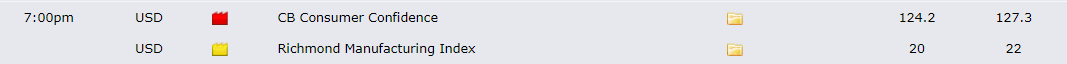

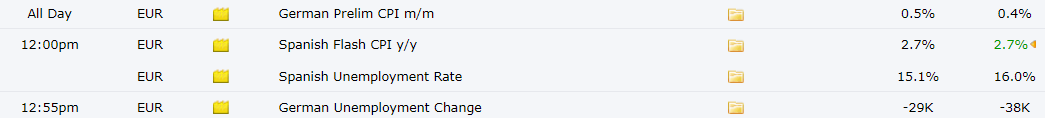

The next week comes with two major events. CB consumer confidence data is expected on Tuesday. The figures are not expected to surprise the market.

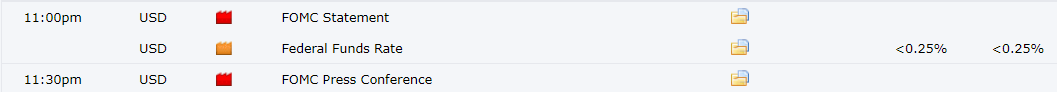

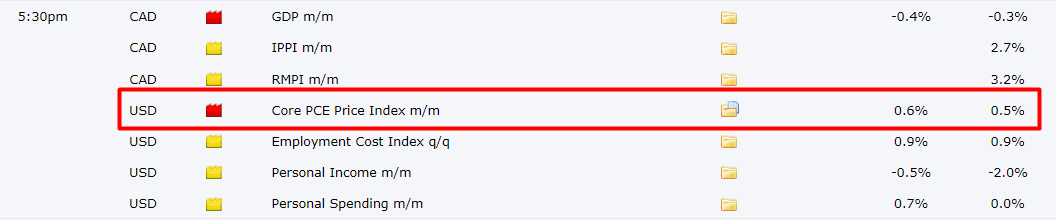

Second is the US federal funds rate and FOMC statement due on Wednesday. We have to look for the tone of the FOMC in their statement. On Friday, we have personal spending and income data as well which includes PCE inflation as well. PCE inflation is a hot variable of inflation measure for the Fed.

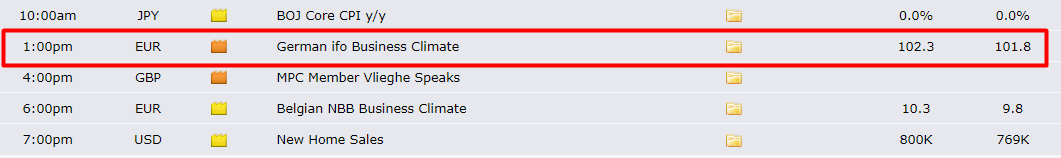

The Euro side is quite dull next week in terms of the news releases. Only the German business climate and German unemployment figures can slightly impact the pricing.

EUR/USD weekly technical forecast: Bears to seek further strength

EUR / USD spent a week near the 1.1750 mark. The bears are preparing to continue hitting the new lows. The relative strength indicator has slowed down the decline. Therefore, recovery to the neutral zone is expected. After the retest of the downward trendline, the weakening of the European currency will resume. Thus, the forecast for EUR/USD for the week of July 26-30, 2021, provides for a limited correction with a subsequent decline. The renewal of the April lows will open the way to the psychological level of 1.15.

–Are you interested to learn more about forex options trading? Check our detailed guide-

On the daily chart, the bearish 20 SMA converges at the upper border of the range, while the 100 SMA and 200 SMA have formed a bearish crossover of around 1.2000. The momentum indicator cannot determine the direction below 100, and the RSI consolidates near oversold levels, supporting the downside risks.

Support is seen at 1.1751 (weekly low), 1.1703 (mentioned above), and a weekly close below 1.1600 will bring 1.1470 (long-term static level) into play.

A rise above 1.1840 will aim the bulls at the resistance at 1.1920 (61.8% Fibo corrections of the mentioned rally) and 1.2000.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.