- Financial markets continue to reject risk due to the crisis in Eastern Europe.

- Investors were surprised by a tightening of monetary policy by the US Federal Reserve.

- A new yearly low of 1.0805 is on the horizon for the EUR/USD pair.

The EUR/USD weekly forecast is slightly positive as the US dollar retreated last week despite the Fed’s rate hike. In addition, the Russia-Ukraine peace talks improve the risk sentiment.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The EUR/USD pair recovered last week, closing at 1.1050, after hitting the weekly highs of 1.1136. After three weeks, the financial markets were preoccupied with the development of Russian-Ukrainian relations and the lack of progress in the peace talks.

The Russian invasion of Ukraine

Suppose it aligns with its main strategy, which is for Kyiv to recognize Donbas’ independence by establishing the Donetsk and Luhansk People’s Republics. In that case, Russia is generally open to a diplomatic solution. However, Ukraine has made it clear that it will not negotiate “an inch of Ukrainian territory,” according to Igor Zhovkva, one of Zelenskyy’s aides.

The safe-haven dollar traded back and forth amid controversy over negotiations this week, and sentiment-based trading was briefly halted by the US Federal Reserve’s monetary policy announcement.

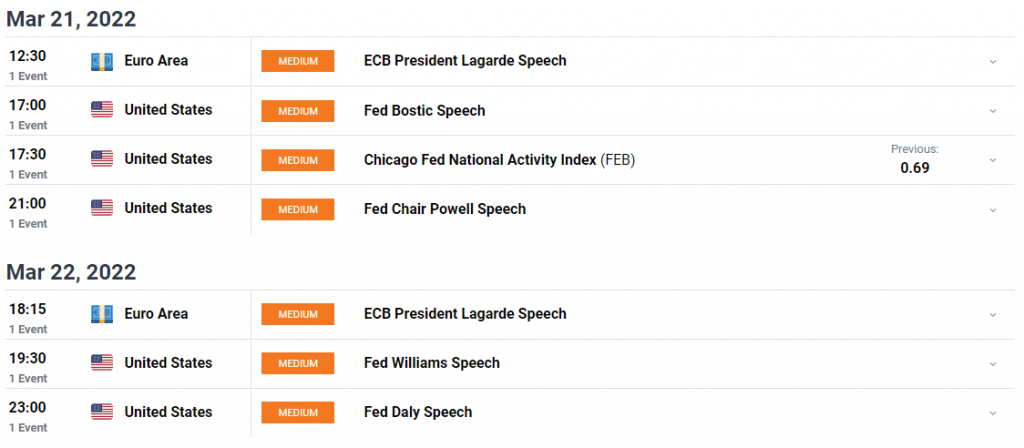

Interest rates were raised by 25 basis points by the US Federal Reserve, but hawkish comments regarding upcoming meetings surprised market participants. There are six more rate hikes this year on a dot chart, while Chairman Powell said they are making “excellent progress” on trimming the balance sheet, adding that details could be agreed by May.

It has also been noted by several central bankers that the Russian-Ukrainian conflict poses a risk to economic growth and inflation. Meanwhile, international sanctions continue to pile up against Moscow, and it refuses to budge an inch.

Covid headlines

Coronaviruses are again making headlines due to a pandemic. By imposing strict lockdowns on major cities, China has reported record infections. European restrictions are loosened as a new wave invades the region and cases increase. Will it succeed as the world moves towards learning to live with this disease?

The effectiveness of vaccines in preventing serious diseases has been shown, but vaccinations every four months do not appear to be sustainable. In addition, although antiviral drugs have been developed, they are far from perfect.

In spite of China’s measures, it seems unlikely that the West will turn back to quarantine or adopt other restrictive measures.

EUR/USD forecast: Week ahead

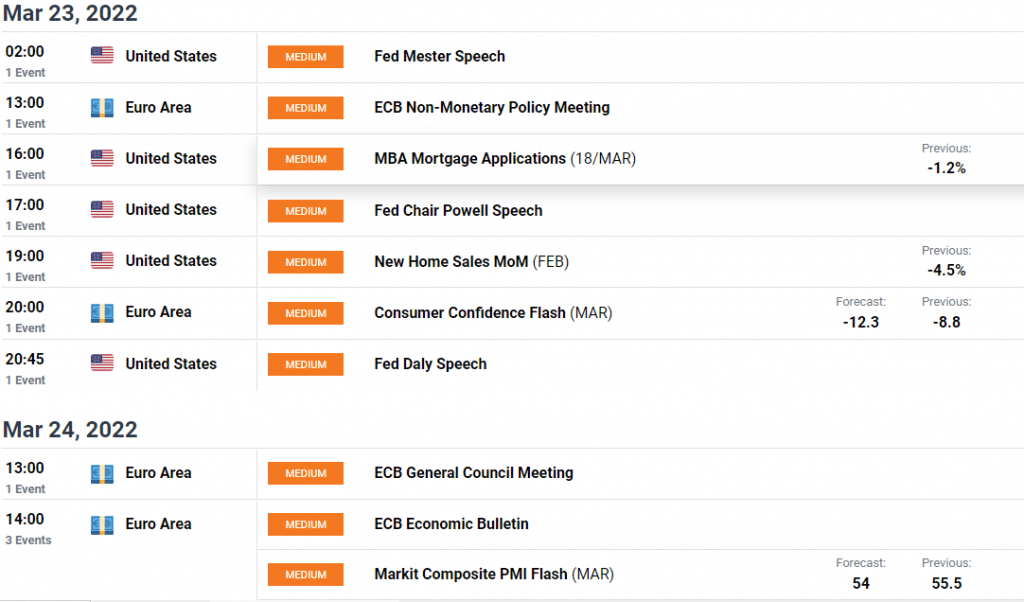

Several macroeconomic releases over the past few days indicate that economies are feeling the heat of war. In March, the ZEW survey of German businesses showed the business sentiment index fell to -39.3 in the country and -38.7 in the EU as a whole. Meanwhile, inflation in the Union increased by 5.9% y/y when the February figure was revised upward.

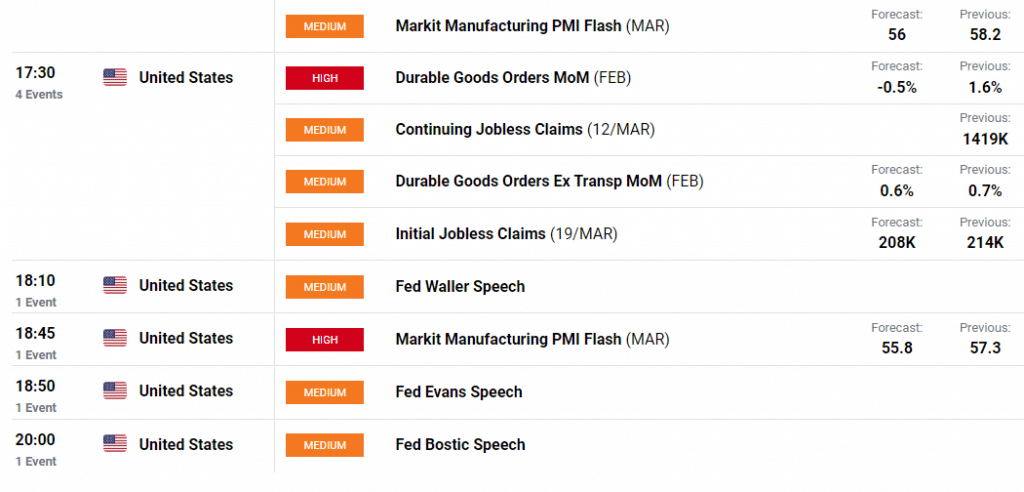

Similarly, US retail sales rose 0.3% in February, while the PPI for the same period was confirmed at 10%.

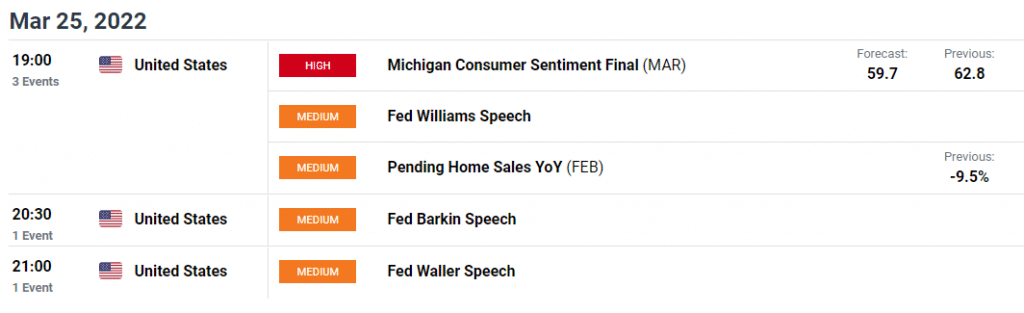

Markit will release its March manufacturing PMI estimates this week, while the Commerce Department will release February durable goods orders.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

EUR/USD weekly technical forecast: Double top eyed

The EUR/USD price gradually rises on the daily chart, but the 20-day SMA continues to reject the bulls. There is an imperfect double top at 1.1126-33 which will be the next target for the bulls. If double top breaks, the price will eye 1.1200 handle.

On the flip side, the multi-month low of 1.0800 will be the target for the bears. The volume data is pointing at further gains.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money