- The EUR/USD pair started the week at 1.1809, marked highs near the mid-1.1800 where it found sellers.

- US core CPI fell more than expected to 4% y/y in August, indicating that the inflation spike from the opening was temporary.

- Isabelle Chanel says inflation will drop significantly in the new year.

- Following Chairman Jerome Powell’s retreat in Jackson Hole, a policy change is unlikely from the Fed.

The EUR/USD weekly forecast is bearish as the US dollar soared after the US retail sales figures surprised the market.

The EUR/USD pair started the week at 1.1809, marked highs near the mid-1.1800 where it found sellers and closed the week at lows around 1.1720 with a net negative charge of 84 pips.

-Are you looking for the best CFD broker? Check our detailed guide-

US core CPI fell more than expected to 4% y/y in August, indicating that the inflation spike from the opening was temporary. As a result of this news, the dollar was only temporarily depressed since some believe the decline in prices resulted from stagflation – an increase in prices that resulted in less demand.

Rather than the decline forecast by economists, retail sales showed a 0.8% increase in August. Several key figures proved optimistic as well. Contrary to dismal consumer sentiment data, these strong numbers indicate that demand is intact.

The European Central Bank maintains a dovish position. A member of the European Central Bank from Germany, Isabelle Chanel, says inflation will drop significantly in the new year. Given the hyperinflation of the 1920s, European bankers generally dislike inflation. The words of Schnabel put pressure on the Euro.

In contrast, according to the Financial Times, ECB chief economist Phillip Lane told bankers privately that a rate hike is likely within two years. Following the bank’s refusal to report, Euro appreciation ended.

What’s next for the EUR/USD weekly forecast?

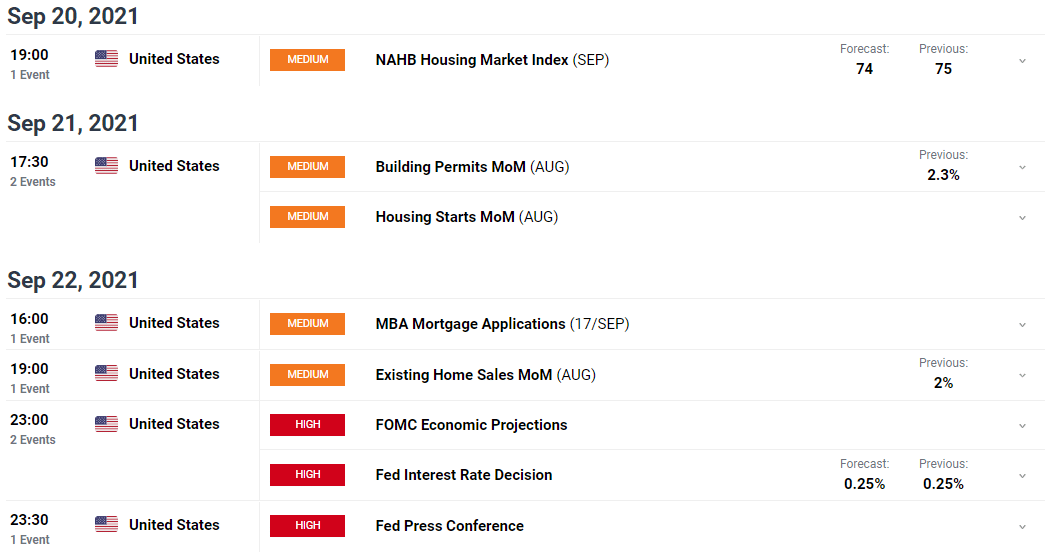

There are a variety of surveys on the economic calendar. Germany’s IFO business climate could also remain negatively affected by the declining consumer confidence in the Eurozone.

Thursday brings the most important release of the week – preliminary Markit purchasing managers’ indexes for September. Lack of resources, inflation concerns, and uncertainty about China’s economy may lead to its decline. A positive turnaround in Europe’s Covid situation and central bank support could lift morale, however.

What is the Federal Reserve’s plan for ceasing to purchase bonds monthly for $ 120 billion? Markets have been grappling with this question over the past few months, and some clarity may emerge in September. Then, the bank publishes new forecasts, also called “dot plot”.

Following Chairman Jerome Powell’s retreat in Jackson Hole, a policy change is unlikely from the Fed. An indication of movement in November or December, however, will be significant for the markets.

The latest economic data, as well as the relationship between tapering and rate hikes, will be analyzed by investors.

Key data events from Eurozone next week

There are some medium impact data events on Sep 23 that may slightly trigger volatility in the market, followed by Ifo business climate data from Germany, which is a high impact data due on Sep 24.

-Are you looking for forex robots? Check our detailed guide-

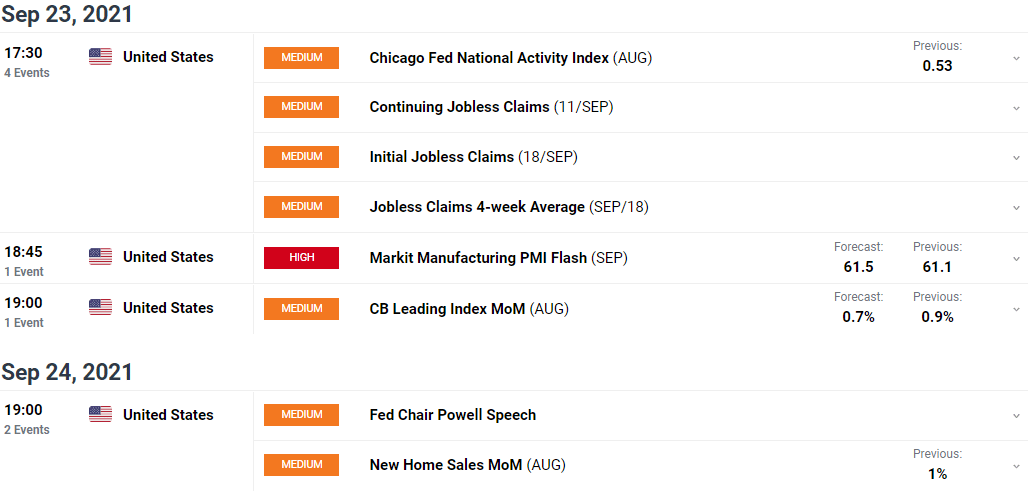

Key data events from the US next week

The week’s major event is the FOMC interest rate decision, followed by the press conference on Wednesday. Investors will likely look for clues of rate hikes and tapering from the press conference. The next important event is Market Flash PMI data on Thursday.

EUR/USD weekly technical forecast: Upside capped by 1.1750

The daily chart shows a strong bearish scenario for the pair. However, the volume slightly decreased. As a result, the pair may likely jump to 1.1750 before continuing its downfall. On the downside, the pair may find support around 1.1700 ahead of the 1.1660 swing lows of Aug 20.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.