- According to the US Nonfarm Payrolls data, the US added only 194K jobs in September.

- Sentiment shifted from negative to positive, hitting the currency as markets rallied.

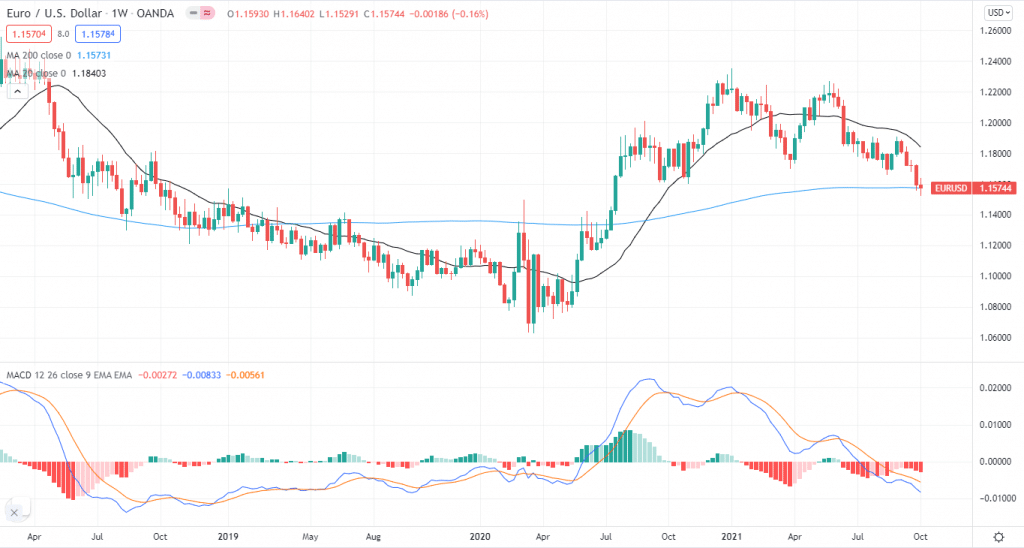

- The EUR/USD is consolidating losses at its 2021 bottom and has room to fall further.

The EUR/USD weekly forecast is bearish as the US dollar continues to grind higher across the board while worrisome Eur figures remain a concern.

-Are you looking for forex robots? Check our detailed guide-

On Friday, October 8, EUR/USD did manage to gain its previous losses due to less-than-expected US jobs data. However, the pullback is short-term, and bears will continue their course.

EUR/USD fundamental forecast

As the globe battles to combat the epidemic, the EUR/USD pair dropped to a new 2021 low of 1.1528. Because the recovery is unequal throughout the world, resuming economic activity will confront significant obstacles and supply chain interruptions.

The case of USD and the shared currency

The US currency profited because of its safe-haven status, gaining strength due to relief stories and anticipation of imminent tapering.

On the other hand, Dismal local statistics weighed on the shared currency, showing a slowdown of growth in the year’s final quarter.

Worrisome figures

The week was jam-packed with statistics, culminating on Friday with the US Nonfarm Payrolls report release. Unfortunately, it was a big letdown, as the country only gained 194Knew employment in September, far less than the 500K forecast.

Following the announcement, the greenback came under selling pressure, but the EUR could not profit from the dollar’s wide weakening.

The German statistics were the most disappointing since the majority of them fell short of market forecasts. Factory orders were down 7.7% month over month in August, while industrial production was down 4%.

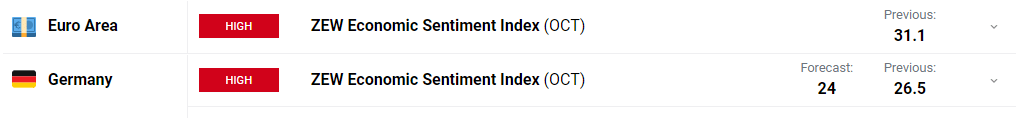

Key Data Releases from EUR during Oct 11-15

On the calendar front, The ZEW Survey for October will be released in Germany this week.

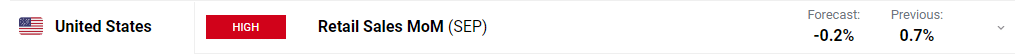

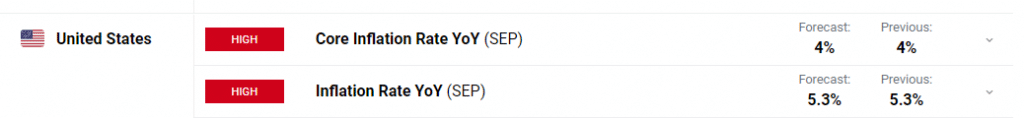

Key Data Releases in the US during Oct 11-15

The big event will be September Retail Sales in the United States, which are expected to be down 0.2 percent for the month. Also, investors will look for Core Inflation figures.

EUR/USD weekly technical forecast: Key SMAs pointing at further losses

The EUR/USD pair is still trading below 1.1600, and the weekly chart indicates that the pair is losing for the sixth week in a row.

-Are you looking for the best CFD broker? Check our detailed guide-

The pair is now trading a few pips below the 100 MA and battling with the 200 MA. Meanwhile, the 20 MA has a negative slope that extends considerably above the present level.

At the same time, the MACD indicator is in the negative territory, consolidating losses at the September lows.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.