EUR/USD is pressured by many factors, but hasn’t broken down from the recent ranges.

What’s next? The team at Bank of America Merrill Lynch weighs in:

Here is their view, courtesy of eFXnews:

Themes: the range will move lower.

“We expect a volatile path towards a lower range for the euro in the rest of the year. We expect the Fed to hike rates this year (our call is for September), and then in every other meeting (two rate hikes this year and four next year). Although the US data flow has not been consistently strong, we believe that it is strong enough for the Fed to feel confident that a slow tightening cycle can begin. At most, the Fed may wait for December, if the next data prints are mixed,” BofA projects.

“We also expect the ECB to sound more dovish in the meetings ahead, starting in September. It is too early to pre-commit for QE2, but Draghi could start preparing the ground for it by reminding markets that QE is at least until September next year and by conditioning QE2 to the inflation outlook.,” BofA adds.

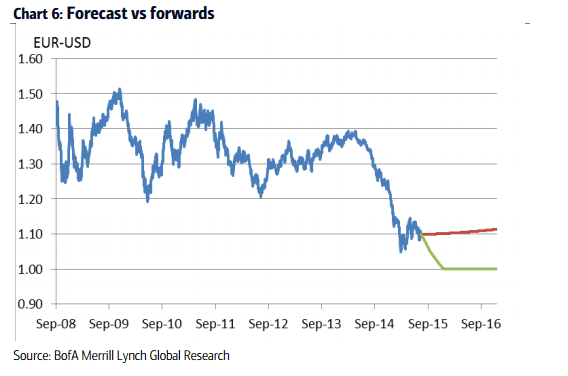

Forecasts: parity. “We are keeping our EUR/USD end-2015 projection at parity. Even if EUR/USD does not reach parity this year, we are confident that it will end 2015 well below the current level. However, we expect the path towards a lower Euro to be choppy, as the US data is not strong enough, at least not yet, to be consistent with a much stronger USD,” BofA projects.

Risks: “Fed, ECB and Greece If the Fed does not hike this year and/or the ECB sends mixed messages following its new projections, EUR/USD could move again towards 1.15. If Grexit risks come back during difficult negotiations for the new 3-year program, the Euro could weaken further,” BofA adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.