The Euro made an attempt to climb higher against the Japanese yen, but failed around the 135.20 level. It failed to clear the same on a couple of times. The EURJPY pair is now correcting lower and it would be interesting to see how it trades in the coming days. There were a couple of releases lined up today in Japan, including the Bank lending, released by Bank of Japan. The outcome was on the positive side, the Bank lending increased by 2.6% in January 2015, compared with the last gain of 2.5%. The Japanese yen somehow traded lower against the US dollar and the Euro after the release.

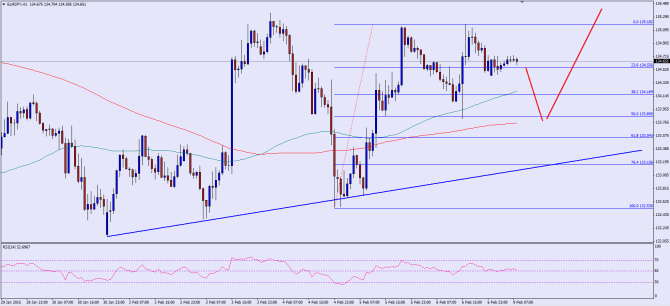

There is an important bullish trend line formed on the hourly chart of the EURJPY pair, which might act as a catalyst in the near term. The most crucial thing to note is the fact that the pair is above the 100 and 200 hour moving averages, which is a positive sign. Currently, the pair is trading around the 23.6% fib retracement level of the last leg from the 132.50 low to 135.18 high. However, there is a chance of a spike lower towards the 100 hour MA, which is sitting around the 38.2% fib level. Any further downside might take it towards the 200 hour MA, which is at 50% fib level.

The most important support is around the trend line, but we cannot deny the fact that there are several supports around the current and lower levels.

Overall, one might consider buying dips in the EURJPY pair as long as it is trading above the stated trend line.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In our latest podcast, we do an Aussie Analysis, Greek Grindings and Oil Optimism.