Euro-zone CPI stands at 1.4% y/y as expected. Core CPI is at 0.9%, lower than 1% expected. The weak core numbers are a headache for the ECB. PPI beat with 0.6%, but it isn’t that important. This is the first release of inflation data, but the final data usually doesn’t deviate from the initial publication.

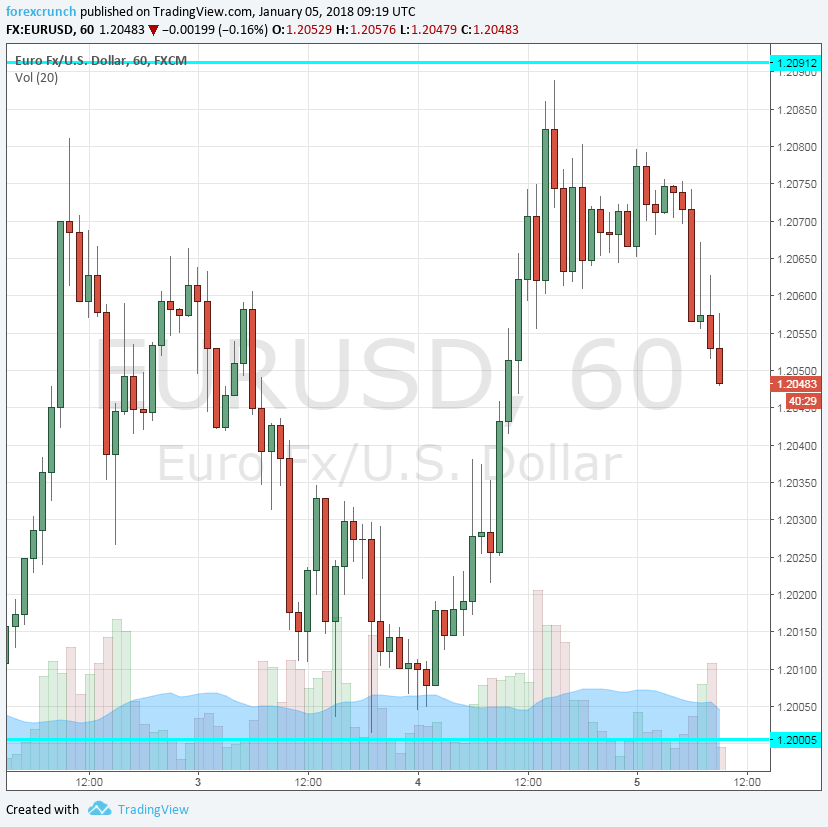

EUR/USD remains slightly lower on the day, at 1.2050. The US jobs report is next up.

The initial read for euro-zone inflation was expected to show that headline CPI rose by 1.4% y/y in December, slower than 1.5% in November. Core CPI was predicted to rise from 0.9% to 1%.

Ahead of the release, EUR/USD was stable within the high range, trading around 1.2050, in the middle between critical support at 1.20 and the 2017 peak of 1.2090.

The weakness on core inflation is one of the reasons that ECB President Mario Draghi remained dovish in his recent public appearances. Despite the accelerated economic growth, underlying inflation is hardly picking up.

Beginning in January, the ECB’s bond-buying volume has dropped to 30 billion euros per month, half of the rate since April 2017. The current scheme is set to run through September and Draghi did not rule out extending the bond buys beyond that date. Some other ECB members wanted to announce the end of the loose policy already in October 2017.

More: EUR/USD: up to 1.25 or first to 1.10? Two opinions

Here are the recent movements on the euro/dollar hourly chart: