After a few months of rapid rises, the headline consumer price index dropped in the euro-zone to 1.5% in March. This is a significant fall of 0.5% from 2% in February. Expectations stood at 1.8%, but were probably downgraded after the miss on German and Spanish inflation numbers.

Worse off, core inflation is down all the way to 0.7%. The measure that excludes energy and other volatile items is at the lowest level in about a year. The y/y figure stood at 0.9% in the past few months after sticking stubbornly at 0.8% for a longer period of time.

So for now, there are no “secondary effects” to the rising prices of energy. It is important to remember that euro-zone unemployment is still elevated despite some falls. In addition, the advance in oil prices came from extremely low levels and at around $50 per barrel, we are still at half the price seen in 2014.

For the ECB, this means that the extension of the QE program is fully justified. They will continue buying bonds until the end of the year. However, the level will be reduced to 60 billion in April.

It seems that tapering the QE program has become less urgent. An extension into 2018 is not off the cards.

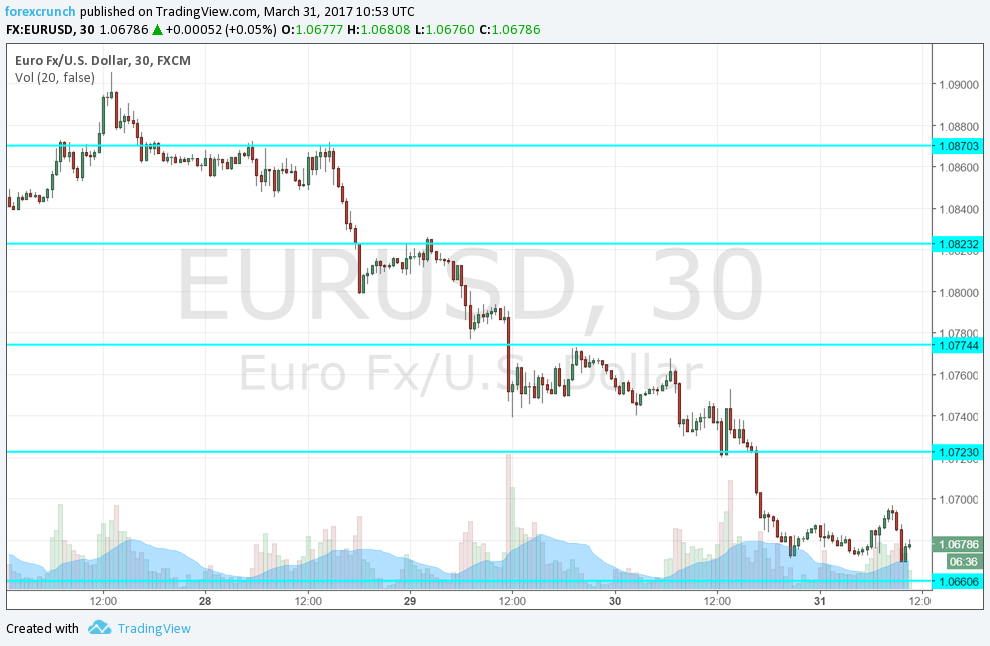

EUR/USD remains in the lower range, but holds onto support, above 1.0660. Resistance awaits at 1.0710. Will it break lower? Perhaps after the week, month and quarter reach their final end. Some last minute adjustment could be in play.