A nice symbolic gesture from inflation numbers to Mario Draghi: prices were flat year over year in March, better than the drop of 0.1% initially reported. Core inflation was left unchanged at 1% – at least above the levels seen in previous months.

EUR/USD is ticking a bit higher towards 1.1270 but isn’t going anywhere fast.

The euro-zone was expected to confirm the initial inflation read for March: a drop of 0.1% in headline consumer price index and a rise of 1% in core CPI.

EUR/USD extended its losses prior to the release. General dollar strength across the board is the reason – there was no euro-related event of significance prior to the publication.

The US reported a mediocre retail sales report. Nevertheless, the greenback, which was already on the upswing, extended its gains. The recession danger is still not in play and this allowed stocks and oil to rise. Later today, the US releases updated inflation figures of its own. Contrary to the old continent, prices are rising at the headline level and at a faster clip on the core: 2.3% in February, better than 0.8% in the euro-zone.

The ECB convenes next week and this figure will feed into the decision. On one hand, the central bank just introduced new monetary stimulus, and quite a lot of it back in March. On the other hand, it will want to keep the pressure on the currency: to maintain its weakness so that the inflation at “2% or a bit below” target can be reached.

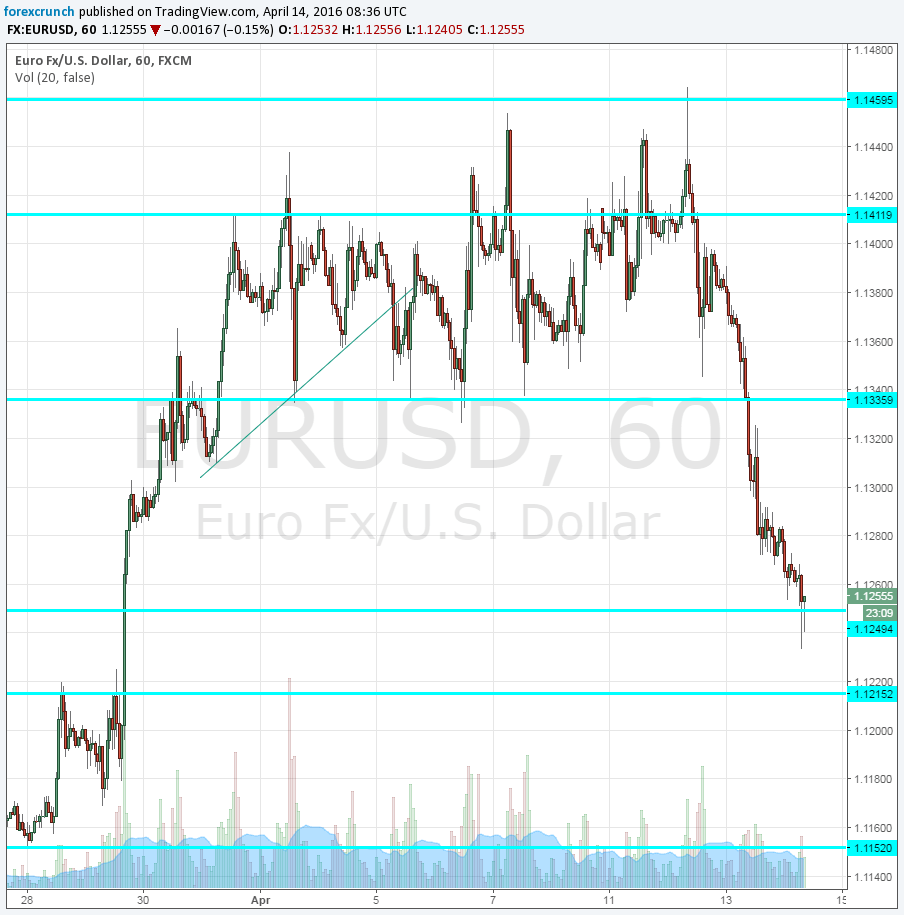

Euro/dollar traded in a narrow range between 1.1335 and 1.1460 for nearly two weeks. This range was lost and the pair reached a new low of 1.1233. Support is seen at 1.1215 and then 1.1150.