The unemployment rate in the euro-zone remains 10.3%, as expected for February. The figure for January was revised up to 10.4%. At the same time, producer prices deteriorated even further: a drop of 0.7% m/m, worse than 0.5% expected and 4.2% y/y, also worse than 4% predicted.

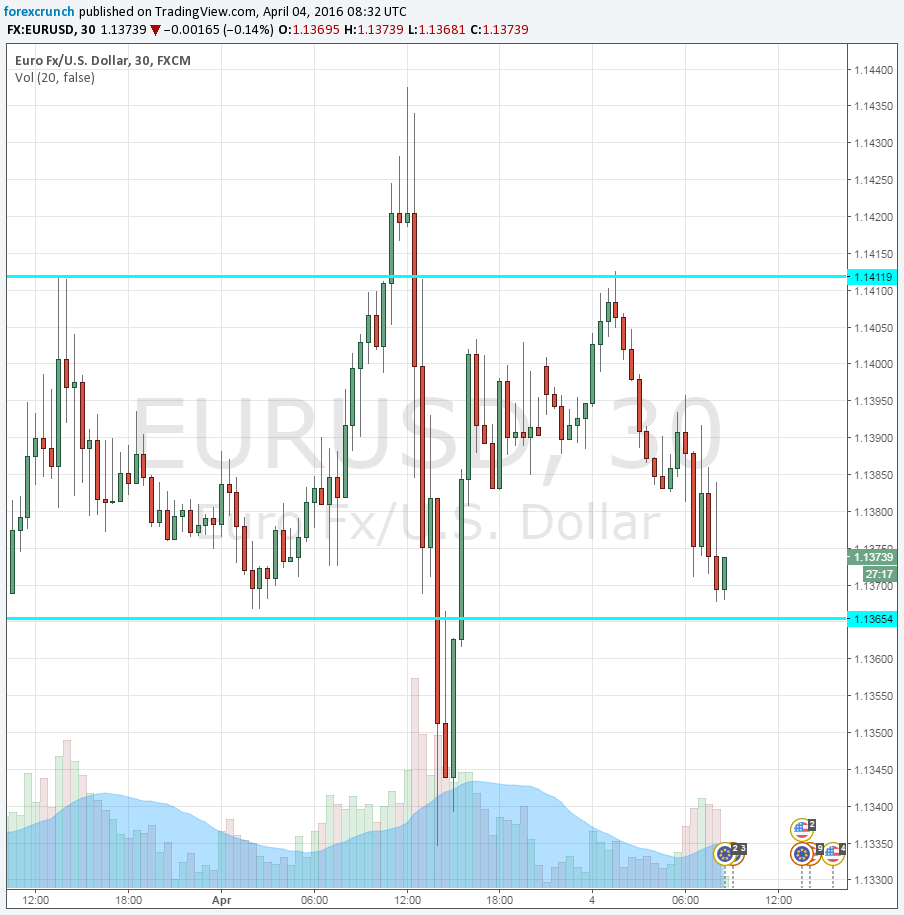

EUR/USD remains at the bottom of the high range, above support at 1.1365.

The Euro-zone was expected to report an unemployment rate of 10.3% in February, the same as in January. In recent months, the employment situation has improved, with a gradual drop and a streak of surprises.

EUR/USD traded around 1.1375 before the release.

Earlier, the Sentix Investor Confidence was expected to rise from the low of 5.5 points to 6.5 points. However, the actual outcome was only 5.7 points.

EUR/USD managed to rise last week, taking advantage of the weakness of the US dollar. Fed Chair Janet Yellen took the most extreme dovish stance yet. She talked about higher global concern, rising uncertainty regarding inflation and talking about being especially cautious. The better than expected NFP on Friday did little to help, at least not against the euro.

In the euro-zone, Greece is back to the headlines with the Wikileaks leak about the IMF wanting to corner Greece. The bigger leak came from the Panama Papers, which spill the beans on the rich and famous.

More: EUR/USD: Towards Key Trendline Following The Historic Pattern – Nordea