EUR/USD has been struggling with the highs, but could go further above. Also the yen has better prospects against the dollar, says the team at Morgan Stanley:

Here is their view, courtesy of eFXnews:

USD levels keeping us bearish: We continue to expect further 4% weakness in USD on the Fed’s broad trade-weighted measure. The DXY has failed to break back into a trend channel formed since June, with the lower end around 94.80. Staying below the 95.30 area should keep the bearish momentum for USD.

One of our favourite ways to play for USD weakness is via EUR. From a technical basis, EURUSD is currently behaving in textbook fashion, and we think shouldn’t be met with much resistance when going through the 1.14 level. We still target 1.16 for the end of this quarter. Dovish academic debate on the shape of future monetary policy from the Fed should support our currency views.

The Fed and inflation: To analyse USD we are paying particular attention to the relationship between market expectations for the pace of rate hikes (MSP0KE Index) and the US 5y5y inflation swap. Any hawkish Fed commentary in the coming weeks would lower inflation expectations from their already weak 1.9%Y level. Hawkish commentary could also weaken the equity market, which could then drive the Fed towards a less hawkish tone. The dynamic we describe and commentary this week should show how trapped the Fed is. The Fed’s Williams’ suggestion to raise rates and the inflation target should flatten the curve and thus weaken USD. Implicitly he wants to lower the terminal real rate by aiming for a higher inflation target. The fact that inflation expectations are not moving higher, currently at 1.9%Y, suggests that the market regards the Williams paper as a theoretical exercise with no practical impact yet. USD should weaken should the higher inflation targeting debate gain substance in Jackson Hole.

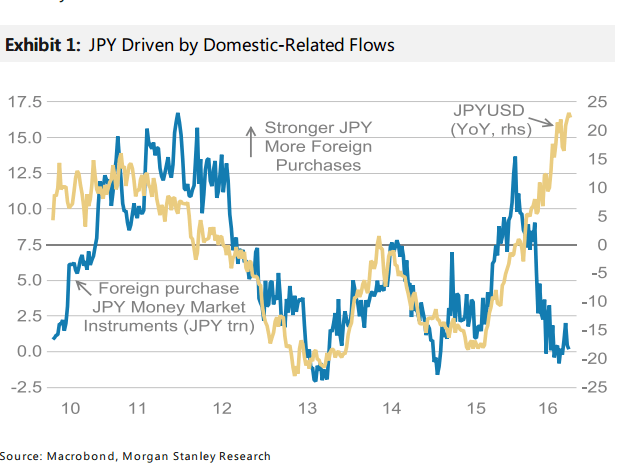

What a weak USD means for JPY: We are still expecting USDJPY to reach 97 this quarter with the current Fed-driven dynamic working more on the USD side of this pair. Local risk-supportive ETF purchases by the BoJ are now causing a large divergence between the currency and equity markets. We think this dynamic can continue as long as the BoJ doesn’t cut rates, something our economists now expect, and so doesn’t have a large negative impact on the Japanese banks. Japan’s Kyodo newspaper reporting that an extra JPY 4.5 trillion of spending was to be approved in a second budget had little impact on USDJPY as it appeared to be another case of repackaging old announcements.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.