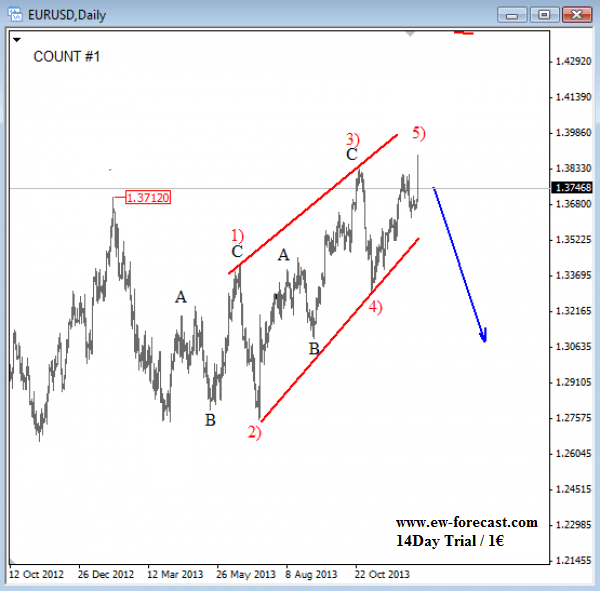

EURUSD has extended its gains in the last few weeks back above 1.3800 and now also to 1.3900 where the market may complete a huge ending diagonal pattern.

The ending diagonal is a reversal pattern which means that EURUSD could fall sharply in the beginning of 2014.

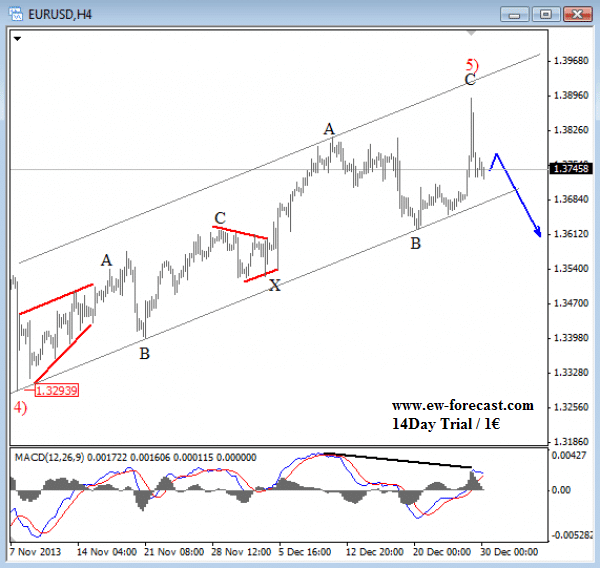

On the 4h chart we can see a recent spike to 1.3900 which makes the move from 1.3290 more extended and complex. Notice that we labeled the rally in wave 5) as a double zigzag because of the overlapping price action.

Keep in mind that we are tracking an ending diagonal on a daily chart as mentioned about where each leg has a corrective structure. So if our count is correct then a bearish turning point could be near, especially if we consider a 150 pip pullback from latest high.

We suspect that the pair will continue lower, but we would love to see broken channel support line as well as wave B swing low to confirm a change in trend. We can also see a bearish divergence on the MACD that is calling for a turning point.