EUR/USD sold the fact of Macron’s expected ascendancy to the French presidency. After a false break above 1.10, the pair turned to the downside. The drop was not limited to the US dollar: the common currency slipped across the board. This was a classic “buy the rumor, sell the fact”. The last opinion polls showed Macron gaining momentum.

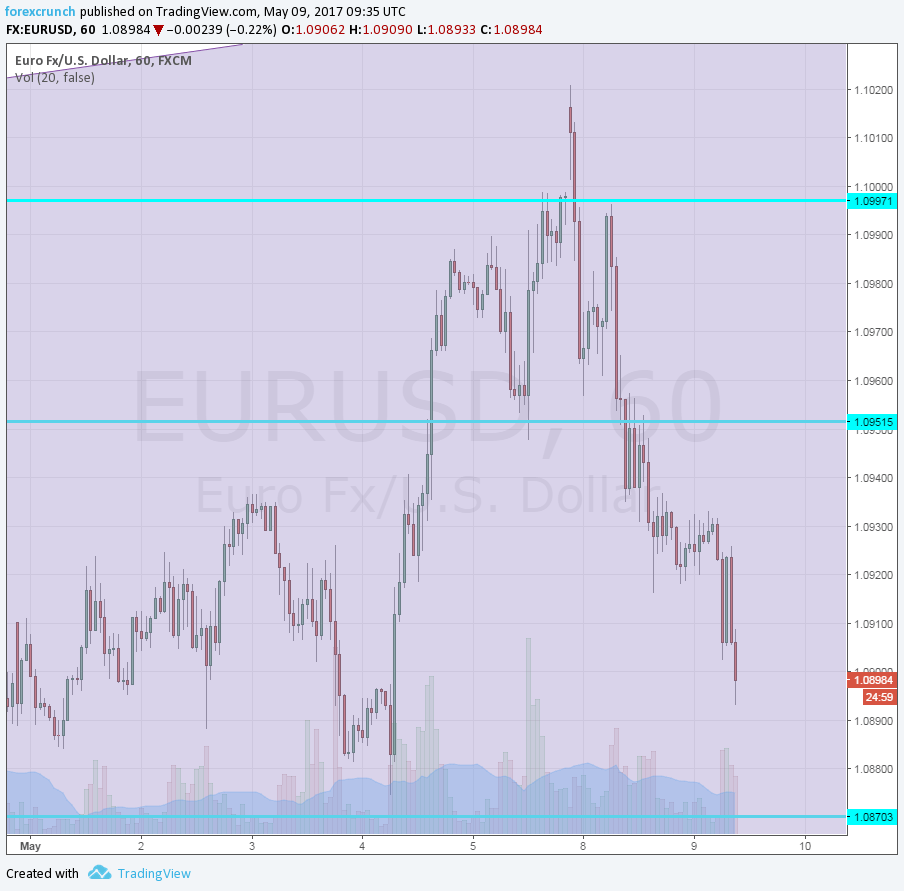

EUR/USD is now extending its losses below 1.09, reaching a new low at 1.0893. Further support awaits at 1.0870, the December 2016 high. Even lower support is at 1.0820. This was the lowest level after the first round of the French elections. On the upside, 1.0950 and 1.10 are notable.

Contrary to yesterday’s drop, this fall is related to the dollar’s strength. The greenback is on a roll against the yen, with USD/JPY hitting 113.80. GBP/USD is getting further away from the 1.30 level.

Why is the dollar rising? This is harder to tell. The most recent data is the Non-Farm Payrolls report. It showed a strong gain of 211K, better than expected. On the other hand, wage growth slowed down to 2.5%. This does not bode well for the June Fed decision.

EUR/USD still trending higher

Here is the EUR/USD hourly chart. While the recent drop is clear to see, the trend since the beginning of the year is to the upside: higher lows and higher highs.

More: What’s next for the euro? Dip buying?